TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

UPDATE: Some or all of the offer(s) mentioned in this post have now expired

Right now, a number of Chase credit cards are offering cardholders capped discounts of 10% or 15% on Hyatt spending made by the end of the month, but per the offer’s terms and conditions, these savings are only available for spending made at Hyatt’s domestic properties. Those terms, however, may not actually reflect how things really work.

The current Hyatt offers from Chase

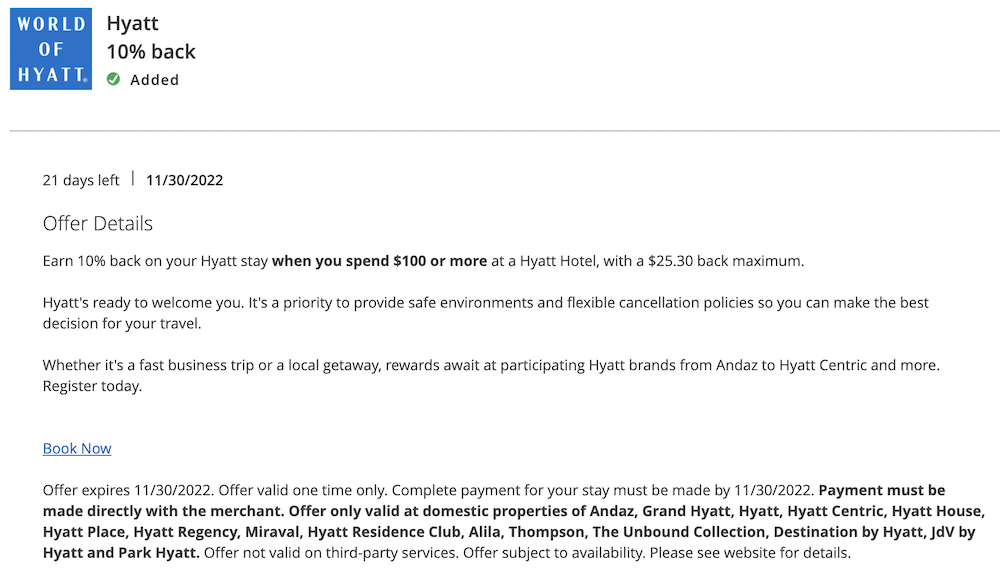

Right now, my Chase Sapphire Preferred® Card is offering me 10% back through 30 November when I spend $100 or more at “domestic properties” (the rebate is capped at $25.30).

And my Ink Business Preferred® Credit Card is offering me 15% back when I spend $100 or more “at domestic properties”with an earnings cap of $37.95.

There’s no ambiguity in the terms linked to these offers as they both clearly state that they’re only valid “at domestic properties of Andaz, Grand Hyatt, Hyatt, Hyatt Centric, Hyatt House, Hyatt Place, Hyatt Regency, Miraval, Hyatt Residence Club, Alila, Thompson, The Unbound Collection, Destination by Hyatt, JdV by Hyatt and Park Hyatt” so there’s no way that a stay at a Hyatt property outside of the US should trigger the credit.

But it can.

The mini experiment

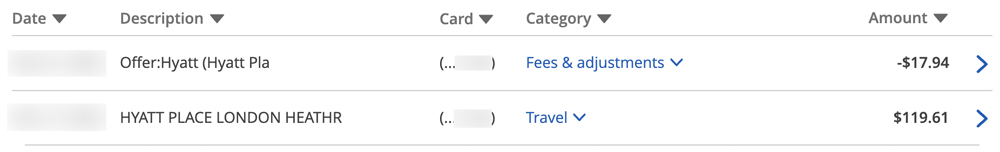

Earlier this month, I stayed at the Hyatt Place London Heathrow and because the stay was a relatively cheap one and because my Ink Business Preferred® credit card effectively earns me just one fewer Hyatt points/dollar on Hyatt stays than the World of Hyatt Credit Card*, I decided to see what would happen if I used my Ink card to pay for my stay.

Well, after checking out with my Ink card, there was no email or phone alert from Chase to let me know that I’d used one of my offers, and in three days after the Hyatt Place charge posted to my account, no rebate appeared.

Then, on day 4, success!

The 15% rebate that was very clearly only meant to trigger on spending made at domestic Hyatt properties hit my account.

I have no idea if this is something that will happen at all overseas Hyatt properties or if only specific overseas Hyatts will trigger these types of Chase offers, but I plan to find out and I’ll report back here when I have more to share.

Bottom line

Just because the terms and conditions of a Chase Hyatt offer say that the offer is only redeemable at domestic properties, doesn’t mean that that’s actually the case. As evidenced by my recent experience, it’s possible to trigger these kinds of offers when staying at Hyatts outside of the US, but as things stand, it’s unclear if this is something that will happen on all foreign Hyatt stays or only on some.

*The Ink Business Preferred® Credit Card earns 3 Ultimate Rewards Points per dollar on up to $150,000 of travel spending every year and Ultimate Rewards Points convert to Hyatt points in a ratio of 1:1. The World of Hyatt credit card earns cardholders 4 points/dollar for eligible Hyatt spending.