TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

UPDATE: Since this post was written American Express has announced a series of benefit changes that are being implemented from 1 January 2020 and these changes affect the information on the Platinum Card found below. Follow this link for more details.

Note: At the time of writing Traveling For Miles does not have a financial relationship with American Express, Chase or Citi so there are no credit card affiliate links in this post.

Towards the end of June, Citi dropped a huge devaluation right into the laps of the majority of its cardholders when it announced that it would be removing a whole host of card protection benefits that most of us have taken for granted over the years.

Outside of earning miles and points, one of the major reasons for using a credit card over a debit card is that most credit cards offer better consumer protections than debit cards (a fact that Citi appears keen to disprove), so this move from Citi was both unexpected and a little brutal.

What made things worse was that it quickly became apparent that it wasn’t just the no-fee/low annual fee credit cards that were seeing their protection benefits slashed – even the high-end, $495/year, Citi Prestige card was in the firing line.

In the miles and points world it can sometimes appear as if it’s the earnings that each bank card offers that are all that really matter but, once you get talking to people, you soon find out that the protections that the cards offer can be just as important…and sometimes even more important than a card’s earning potential.

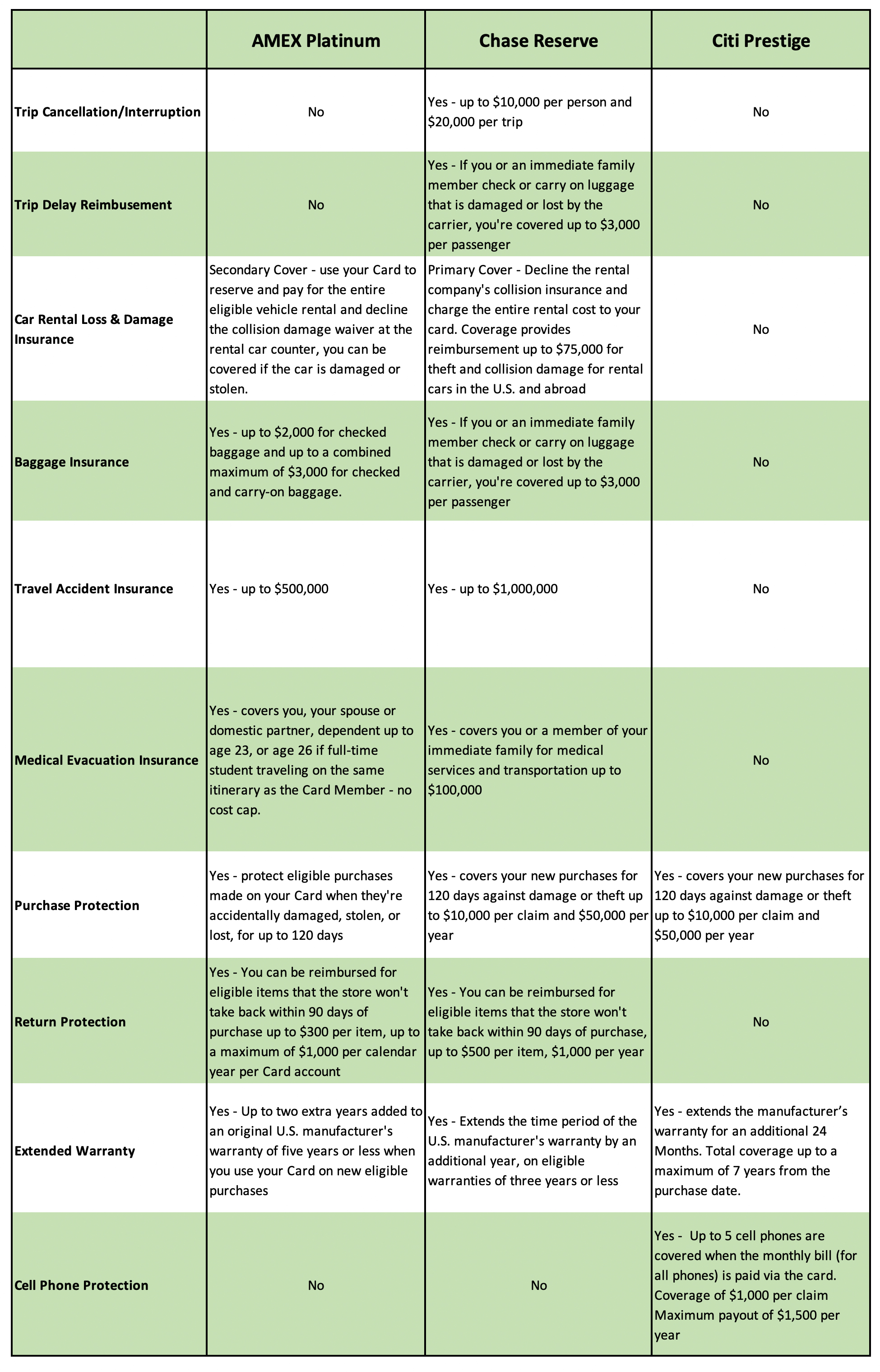

Right now the three most high-profile (and probably most widely held) premium bank cards are the Platinum Card from American Express, the Chase Sapphire Reserve Card and the Citi Prestige card so, with the Citi Prestige card seeing its protection benefits slashed, I thought I’d take a high-level look at the main protection benefits each card offers.

Note: the information for the Citi Prestige card refers to the benefits which will be on offer from 22 September 2019.

Please be aware that this isn’t meant to be an exhaustive list of protection benefits (just the more key ones) and there are nuances to some of these benefits that will require cardholders to read their cards’ terms and conditions carefully and fully to understand the coverage they are entitled to.

Bottom Line

Overall, and I appreciate that this is a subjective opinion, the Chase Sapphire Reserve card has the best all-round protections now that the Citi Prestige’s benefits have been gutted.

It’s the only one of the three premium cards to offer trip cancellation/interruption insurance and trip delay reimbursement, and it’s the only one of the three to offer primary coverage when it comes to rental car protection.

The Platinum Card from American Express offers the most impressive medical evacuation insurance, but the Chase Sapphire Reserve offers a higher level of cover for travel accident insurance.

Both the Platinum Card and the Citi Prestige appear to offer better extended warranties than the Reserve card, but then the Chase card hits back with slightly better coverage for returns protection.

The Citi Prestige’s only real claim here is that it’s the only one of the three premium cards to offer cell phone protection but, as you can get similar cell phone protection with a considerably cheaper business card from Chase (the Chase Ink Business Preferred), that’s not exactly much to brag about.

The upshot of all this is that if you hold all three of these cards (or the Reserve card and one other) you’re left facing a dilemma when it comes to choosing which card to use when booking air travel.

Do you take the 5 points/dollar earnings (offered by the Citi Prestige and the Platinum Card) or do you accept the 3 points/dollar earnings offered by the Chase Sapphire Reserve in exchange for better travel protection?

Personally, I think I’ll be mixing up my flight bookings a lot more from now on.

Trips involving tight connections and cities where weather issues are common will be booked using my Reserve card, while trips without layovers and to/from destinations where bad weather is unlikely to be an issue will probably be booked using either my Platinum Card or my Prestige card…but that’s only assuming I continue to hold both long term.

Right now I can’t see me renewing my Citi Prestige card for another year and you just have to look at the table above (and the recent other devaluations) to see why.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)