TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

The card_name is probably the most important card a United Airlines frequent flyer can hold as it’s the card that offers the best earning rate for spending with United Airlines, and it’s also the one card that can help make membership of United Airlines Clubs a lot more economical.

To add to all that, the card_name currently comes with a fantastic welcome bonus that makes its offering all the more tempting.

Key card facts

Key card facts

Annual fee

- annual_fees

Welcome bonus

bonus_miles_full (find out more).

Earning rates

- 4 miles/dollar spent on purchases made directly with United Airlines

- 2 miles/dollar spent on all other travel purchases

- 2 miles/dollar spent on dining (includes delivery services like GrubHub and DoorDash)

- 1 mile/dollar spent in all other categories

Note: This product is available to applicants who do not currently hold any United Club cards and who have not received a new cardmember bonus for any United Club card in the past 24 months.

Why this can be a great card

United Club membership

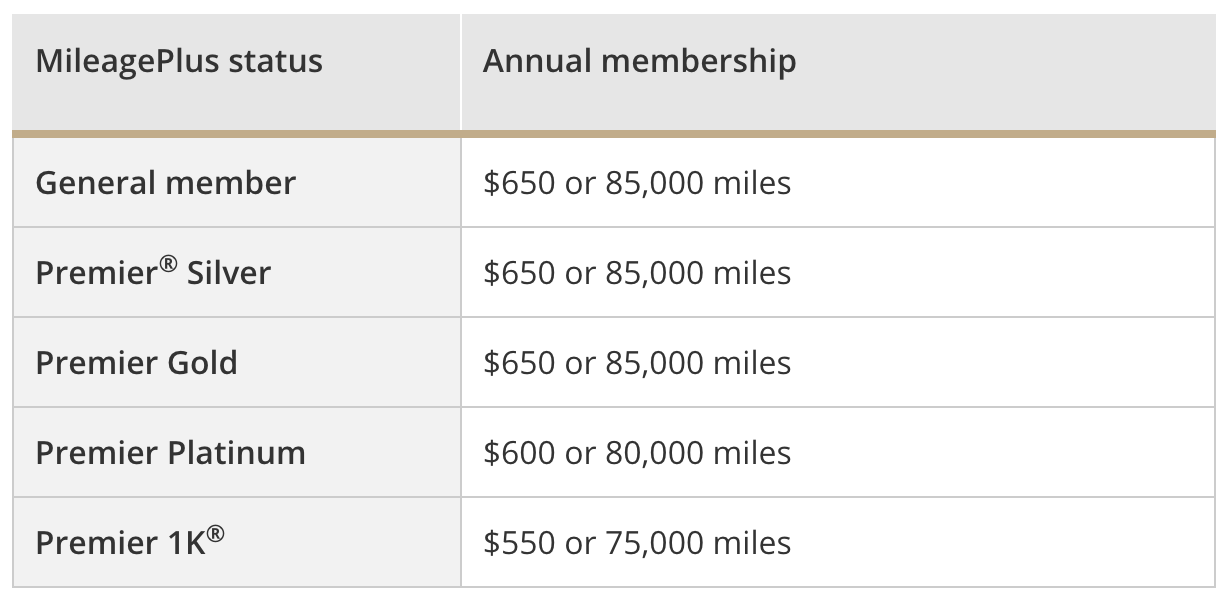

The biggest benefit that the card_name offers is United Club Membership which, depending on your elite status with United, can be worth up to $650 per year.

If you’re a frequent flyer and United is your airline of choice, Club membership probably comes pretty high on your list of things that make domestic flying a little more bearable, so you probably have a membership already.

Well, even if you’re a Premier 1K flyer, you can hold this card and enjoy the Club membership that it offers for less than a standalone Club membership will cost you, and yes, guests are allowed too – the membership offered by this card allows the primary cardholder to bring two guests into the Clubs with them.

For a lot of United Airlines flyers, this makes holding the card_name as close to a “no brainer” as we see in the miles and points world as they’re faced with a simple choice: United Airlines Cub membership at a cost of at least $550 or United Airlines Club membership *and* all the benefits of the card_name for annual_fees.

United Airlines earnings

No card offers as strong an earning rate on United Airlines spending as the United Club Infinite Card.

With its earning rate for United Airlines spending set at 4 miles/dollar, the card_name beats out the card_name and all the Chase Ultimate Rewards Cards which will earn 3 miles/dollar at best.

That extra 1 mile/dollar may not sound like much, but it represents a 33% increase on the next best card and if you’re spending a lot of money with United, that 33% soon adds up to quite a few extra miles.

Premier qualifying points (PQP)

If you’re aiming to earn or retain United elite status you’ll have to hit the Premier qualifying points (PQP) and Premier qualifying flights (PQF) targets that the MileagePlus program set and the card_name can make that a little easier.

Primary cardholders earn 500 Premier qualifying points (PQP) for every $12,000 in net purchases made on the card up to a maximum of 8,000 PQP in a calendar year (authorized user spending will count towards the spending targets).

For high spenders, this card can offer a very nice shortcut to earning or retaining United elite status which become more expensive to earn from the start of this year.

25% rebate on inflight purchases

I’ve already discussed how this card will save money for anyone who usually buys a standalone United Club membership, but the savings this card offers don’t end there.

When a cardholder uses their card_name to purchase food, drinks, or Wi-Fi onboard a United Airlines operated flight, they will receive a statement credit equal to 25% of the amount paid.

If you’re one of United’s frequent flyers (or aspire to be a United frequent flyer), that 25% effectively represents a rebate on the card’s annual fee every time that you trigger it, and if you’ve seen what United charges for Wi-Fi, you’ll know how significant those savings can be.

Two free checked bags

Another way the card_name can save a cardholder (and traveling companions) some money is when it comes to checked bag fees.

The primary cardholder and one companion traveling on the same booking will each receive their first and second checked bags for free on United-operated flights as long as the booking is paid for using their card_name.

With the first checked bag costing $35 and the second checked bag costing $45, this can represent a saving of up to $320 per round-trip.

Note: Admittedly, this is a benefit that will mostly be of use to flyers who don’t have United elite status as even Premier Silver members get a free checked bag on United Airlines.

Priority treatment at airports

Holders of this card and their traveling companions receive access to priority check-in, priority security screening (where available), priority boarding, and priority baggage handling.

Global Entry or TSA PreCheck credit

A holder of the card_name receives a statement credit of up to $100 every four years to cover the cost of Global Entry or TSA PreCheck when they use their card to pay for their enrollment in either of those programs.

In the grand scheme of things, this isn’t a huge deal (a number of other premium cards offer this benefit), but this is still a nice saving that the Infinite card offers and it’s just another thing that can make the annual fee a lot easier to justify.

Roundup

The card_name is a card that United Airlines frequent flyers should find pays for itself with quite a bit of ease and then keeps paying back even more. The card costs annual_fees per year, while the cheapest United Club annual membership costs $550 (for Premier 1K members) so, straight away, all United Club members would be better off holding the card_name (and enjoying all of its benefits) rather than paying for Club membership.

The 25% back on inflight purchases, the free checked bags, and the Global Entry/TSA PreCheck credit that the card_name offers all just add to the fact that in the right hands, this is a card that shouldn’t cost anything extra to hold.

It’s also worth remembering that as there isn’t another available credit card that will earn a cardholder more miles for spending with United Airlines than this one, so this is the card that anyone looking to boost their MileagePlus balance should be using.

Bottom line

The Ucard_name is a great card to hold if you’re a United Airlines frequent flyer because it offers valuable United Club membership (as well as a variety of other benefits) for less than the cost of standalone United Club membership, and it earns cardholders more miles per dollar on direct spending with United Airlines than any other card on the market.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)