TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

UPDATE: Some or All of the offer(s) mentioned in this post have now expired

The Chase Freedom credit cards are amongst the best no annual fee credit cards you can hold thanks to the way they pair with the Chase Sapphire Reserve and Chase Sapphire Preferred credit cards.

Right now, and for the rest of March, Chase is offering holders of the Chase Freedom Card and the Chase Freedom Unlimited Card 10% cash back on hotel bookings (up to a maximum spend of $2,500) (OFFER EXPIRED)

If you hold either of the Chase Sapphire cards this cash back can be converted to Chase Ultimate rewards points at a rate of 1 cent : 1 point and this can look like a truly fantastic deal if you don’t think things through.

Earn 10% Cash Back On Hotel Bookings With The Chase Freedom Cards (Offer Expired)

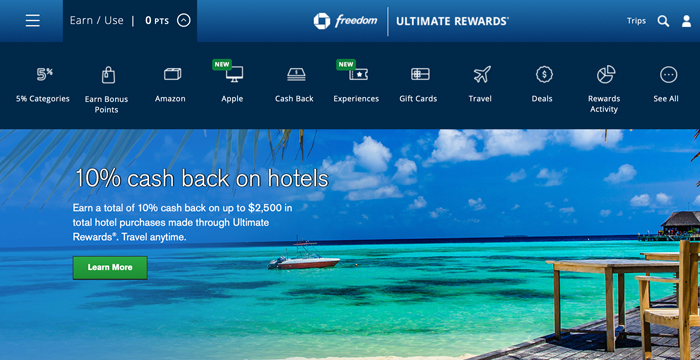

If you hold one of the Chase Freedom cards you should see the 10% cash back offer as soon as you open up the Ultimate Rewards homepage. This is what I see when I log in:

Headline Terms & Conditions

- During the promotional period of March 1 to March 31, 2019 11:59 p.m. E.T., earn an extra 9% cash back on up to $2,500 in combined hotel purchases made through Chase Ultimate Rewards® using your Chase Freedom card.

- The bonus cash back earned is in addition to the 1% cash back you earn on all purchases for a total of 10% cash back, which means you can earn up to $250 total cash back ($25 cash back plus your $225 bonus cash back).

- Bonus cash back will post to your account within a week of the transaction posting, and will appear on your monthly credit card billing statement and be available for use within 1-2 billing cycles.

- To qualify for this promotional offer, account must be open and not in default at the time of fulfillment.

- This promotional offer is non-transferable.

That’s all simple enough but most readers should probably be avoiding this promotion.

The Issues With Booking Though Chase

Issue One

All bookings made through the Chase Travel portal will be classified as ‘3rd party bookings’ by the hotels and this means that….

- You will not earn redeemable points with the hotel loyalty programs for your stays

- You will not earn elite credits with the hotel loyalty programs for your stays

- You will (most probably) not be allowed to use the benefits afforded to you by your hotel elite status during your stays.

Essentially: No room upgrades, no points earning, no free breakfasts, no lounge access (unless you pay extra for it) and, all in all, no elite recognition.

The loss in elite benefits and earnings will, in a lot of cases, far outweigh the value of any cash back or Chase Ultimate Rewards points you may earn.

Issue Two

Bear in mind that Chase Sapphire Reserve (3 points/dollar) and Chase Sapphire Preferred (2 points/dollar) will earn Ultimate Rewards Points on bookings direct with the hotels so, if you hold one of these cards, the offer from the Freedom Cards isn’t as good as it looks.

- If you hold the Sapphire Preferred Card your Freedom Card is only earning you 8 points/dollar more.

- If you hold the Sapphire Reserve Card your Freedom Card is only earning you 7 points/dollar more.

These earnings should be taken into consideration when working out if the extra points the Freedom cards will earn you are worth the higher room rates (potentially), the loss in hotel earnings and the loss in elite benefits.

What if you don’t care about hotel status/elite benefits or if you’re looking to book an independent property?

Issue Three

You cannot use discounts (like those from AAA or AARP) through the Chase Travel portal and you don’t have access to the lower rates hotels sometimes offer members of their loyalty programs so, even if you don’t mind not having access to elite benefits and not earning hotel points, there’s a good chance that you’re not booking the cheapest rate(s) available.

Before booking through the Chase Travel portal you should always check just how much more you’re paying to earn the cash back (or bonus points) that Chase is offering – there’s a good chance the math won’t work in Chase’s favor.

Issue Four

If you hold the Citi Prestige Credit Card and are booking a stay of 4 nights or more you cannot use the 4th night free benefit that the card offers – that’s a big loss to take.

Also, considering the 4th night free benefit can be used without the cardholder missing out on elite benefits, elite earnings or hotel points earnings (for the time being) it’s unlikely that the bonus cash back/points from Chase will make up for missing out on these.

Bottom Line

Yes, there will be times when it makes sense to take the 10% cash back on offer by the Chase Freedom cards but its important you do the math to make sure that’s the case in your situation.

Only you know if the extra points you’ll earn by using a Freedom to book your hotel stay are worth the loss of elite benefits and hotel earnings (and possibly an increased room rate) but it’s far form a foregone conclusion that this is a great deal.

Considering most people who read TFM appear to have (or aspire to) hotel elite status I’m going to suggest that most readers will find that the bonus earnings from the Freedom cards don’t outweigh what they’ll lose by booking their stay(s) through a 3rd part site.

What do you think? Will you be booking your next hotel stay with one of the Chase Freedom Cards?

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

Just a few friendly reminders:

– other OTAs may price differently and/or offer earnings themselves (my favorites are Orbitz and Rocketmiles);

– there are other card-linked offers to compare to – Amex Offers, for example;

– certain cards also offer elite benefits and sometimes credits at certain properties, e.g. MC/Amex at SLH;

– shopping portals often offer 10% CB or 10X miles/points, regardless of the card you use, often on brands whose elite benefits you’d lose through UR

– not booking direct can put you on the shortlist for being walked, since elite members often are compensated for it

All very good points, thanks!