TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Towards the beginning of October I mentioned that I was planning to apply for three new credit cards in the coming months, so, now that my first application is out of the way, I thought I’d write about how the application process went and on the timeline I encountered when it came to being able to make use of the various benefits that card_name offers.

Why I wanted card_name

Because I’ve decided to try to push more of my business towards Hyatt (and away from Marriott) it makes a lot of sense for me to have card_name.

The card gives me entry-level Hyatt status (good for basic upgrades, late checkouts, and bonus points on Hyatt stays), the best earnings rate at Hyatt properties, 5 elite night credits every year, and a free night certificate valid at Category 1 – 4 properties every year.

Those are all benefits that I think are worth the card’s annual_fees/year annual fee.

In addition to the benefits that the card offers, there was one other key reason that I wanted to add it to my portfolio – Hyatt’s promotions.

In at least four of Hyatt’s promotions this year, there have been extra bonuses/benefits on offer for Hyatt co-branded cardholders, and the bonus available in the latest promotion (an extra 15% rebate on award stays made by 4 January 2021) is one that’s especially valuable.

My application & a bit of bad luck

There were two key things that influenced the timing of my application:

- I had a feeling that Chase would be refreshing the welcome offer on card_name and I expected any refresh to introduce a better offer than the one available at the beginning of October. This meant that I wanted to hold off applying for the card until such a refresh happened.

- I had a Hyatt award booking for the middle of October so I wanted to have card_name in my portfolio before my stay so that I’d earn the full 25% award stay rebate that the current promotion is offering. This meant that I had a limited window in which to apply for the card.

I have a credit score in excess of 800 and, before applying for card_name, I had just one hard pull on my credit file in the preceding 24 months so I knew that Chase would almost certainly give me the card.

However, because of how much credit I already have with Chase I was expecting to be asked to move some credit lines around before I was approved, so I also knew that I would almost certainly not get instant approval.

With the date of my Hyatt stay just 3 days away, Chase had still not refreshed the welcome offer that card_name was offering so, as the 25% award rebate was worth more to me than a potentially easier/better welcome offer, I pulled the trigger on the application.

As I had expected, there was no instant approval.

Because I didn’t want to take the chance that Chase would take a few days (possibly even longer) to review my application, I called the number that had appeared during the application process (1-800-527-7419) and, after 15 minutes on the phone with a very helpful agent and after moving credit lines around, I was told that I had been approved for the card.

Then, less than 24 hours later, Chase refreshed the welcome offer on the card and, as expected, it was better than the offer under which I had applied (link to the refreshed offer).

Although I knew it was going to be a fruitless task, I called Chase to see if I could be matched to the new offer. The answer was very quick in coming. There wasn’t even a hesitation or a “let me just check”. The answer was a very definite “no”.

Annoying? A little. Disappointing? Also a little. But the fact is that I knew the risk I was running when I decided to apply and it’s not like the welcome offer I’m now working towards is terrible, so I don’t really have much cause to complain.

You win some and you lose some, it’s all part of the game we play 🙂

Key timeline moments & thoughts

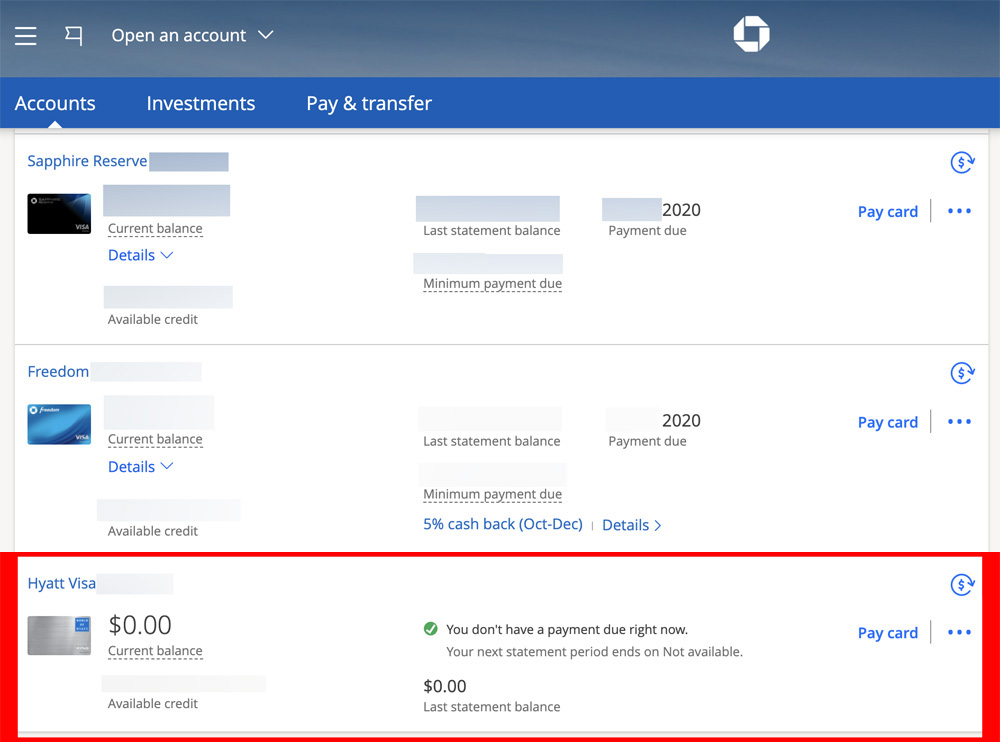

card_name appeared in my online account within 24 hours of my successful application.

Because I’m riding out the pandemic away from my home in LA, my card is being shipped to me overseas, so I cannot use personal experience to tell you how long it takes for the card to be sent out under normal conditions. Chase told me that, usually, the card will be shipped “within a week”.

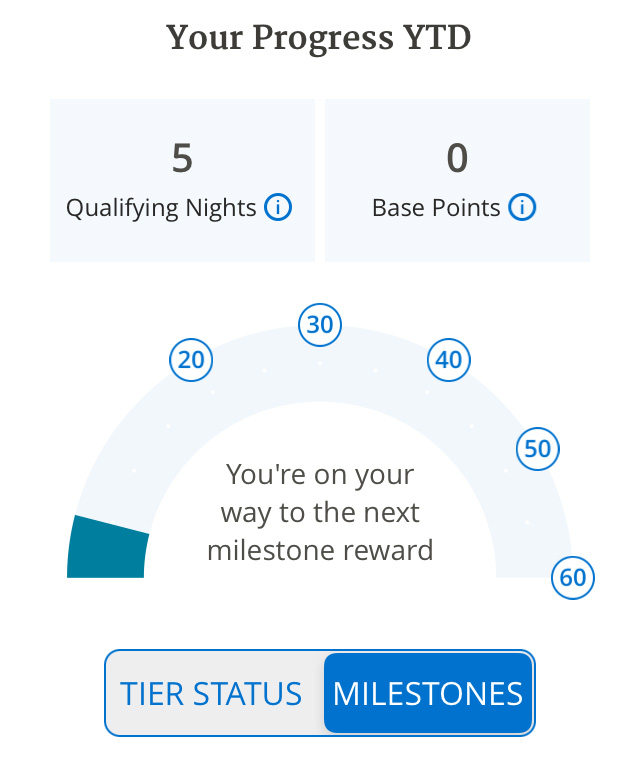

The 5 elite night credits that card_name offers all cardholders every year posted to my account 2 days after my successful application…

… but with 1 day to go to my Hyatt stay (2 days after my application), my Hyatt account still didn’t reflect the Discoverist status that the card bestows upon all cardholders (understandably).

At this point I called the World of Hyatt team to see if there was any way of having Discoverist Status added to my account in time for check-in the following day and, although it turned out that this isn’t possible, I discovered that the incredibly helpful Hyatt agents can notate a guest’s upcoming reservation with a message to let the hotel know that a guest should be given status benefits on their stay.

When I checked in for my stay the agent at the front desk acknowledged my Discoverist status and offered me a 2pm checkout, so the Hyatt agent I had spoken to the previous day had done a great job.

4 days after my successful application (partway through my stay) I received an email confirmation to say that I had been upgraded to Discoverist status,

Following my stay, the points and elite night credits from the stay posted within 24 hours. More importantly, the 10% bonus points that Discoverist status holders get posted without issue as did the bonus points from Hyatt’s excellent year-end promotion.

In the grand scheme of things the points earned from the stay weren’t particularly important because the booking had been made with points – the earnings from the stay and the year-end promotion were only for incidental purchases made at the property.

The thing that I was most looking out for was the points rebate that I was due from the Hyatt promotion that I mentioned earlier.

Would I get the full 25% rebate that holders of card_name are entitled to or would I only get the 15% that all World of Hyatt members are being given?

3 days after I had checked out, I had my answer.

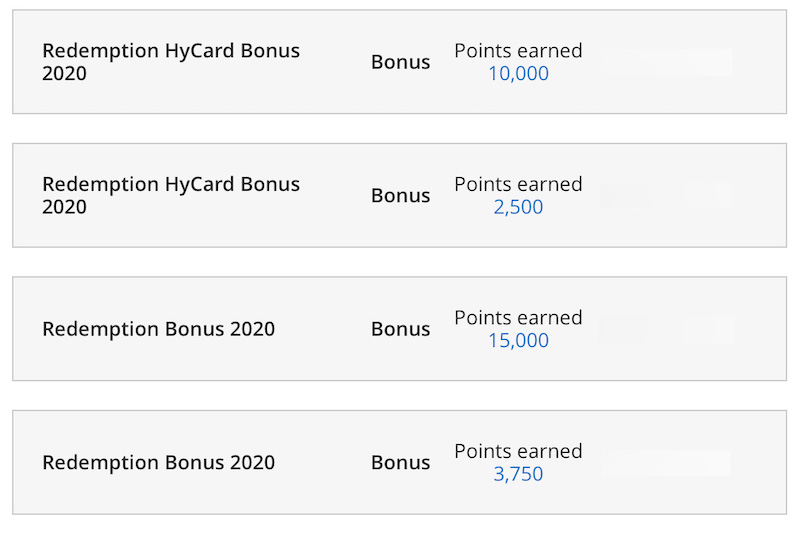

My stay was made up of 2 reservations – one for a single night costing 25,000 points and one for 4-nights costing 100,000 – and this is what appeared in my account:

The bottom two lines represent the 15% rebate that all World of Hyatt members receive while the top two lines represent the additional 10% rebate that holders of card_name are entitled to.

I value World of Hyatt points at 1.4 cents each (based on the value I know that I can easily get out of them) so that values the 12,500 bonus points that card_name earned me at $175.

Given that the card’s annual fee is just annual_fees, that’s a pretty good return after just one stay 🙂

Overall, I was very impressed.

I had only held card_name for a total of 12 days and in that time a Hyatt agent had ensured that my new status benefits (limited and lowly as they are) were recognized by a property before my account showed that I had that status, and my account was credited with all the points and bonus points that I was due – there wasn’t an error in sight and as a long-time Marriott loyalist, that’s not something that I’m used to.

Bottom line

I now hold card_name and so far things have gone well.

Sure, I’m a little disappointed that I didn’t wait another 24 hours before I applied because the new welcome offer is very good, but that really isn’t all that important.

Any disappointment I may feel for missing out on the new offer is easily eclipsed by the fact that I’ve been impressed with how quickly the credit card benefits have been applied to my account, with how accurately all my earnings and rebates have posted, and with how helpful all the Hyatt agents that I’ve spoken to have been.

Lockdowns allowing, I have a further two Hyatt award stays booked this year and with 25% rebates due on both, card_name will have paid for itself at least three times over by the time the rebate from the second stay posts – it’s hard to argue with a return as good as that.

I applied when you did,same issues as you, called Chase, they Jiggled credit limits around approved after 2 weeks. a couple of issues:

a) Only 5 Nights credited instead of 10 (after calling 5 Extra nights will be credited in 8 weeks).

b) Why Don’t I qualify for the New Chase Promotion (Grocery x 3 & Amazon x 5) what Gives?

[…] Although I had already recently decided to move a lot more of my business from Marriott to Hyatt (which is why I applied for the World of Hyatt credit card) I still expected to have a reasonable number of Marriott stays in 2021 and 2022. Now, however, it […]

[…] that I’d be spending a lot more time at Hyatt properties in 2021 – that’s why I got the World of Hyatt credit card in October. If you’re wondering why, the reason lies squarely with how Hyatt has handled itself in […]