TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

In “the good old days” airline miles were a way for airlines to reward their frequent flyers for their loyalty and they were reasonably easy to use for free flights around the world. Nowadays things are different. Airline miles are becoming trickier to use as airlines reduce the number of awards they make available and, more importantly, they’re a lot harder to earn just from flying around.

In the past, the overwhelming majority of airline miles were earned by flying with the airlines that issued them while now that’s really not the case at all. Most miles in circulation nowadays are issued by the banks (credit card sign-ups, credit card earnings etc…) and that means that it’s important that we modify our view of loyalty programs to a view that’s more in keeping with today’s reality.

I’m going to use American Airlines as an example to help illustrate what I’m suggesting in this post but the same logic/thought process can be applied to most mainstream airlines and loyalty programs.

How Earning Miles Has Changed

Up until a couple of years ago American Airlines rewarded its AAdvantage members with miles based on the distance they traveled with the airline or its partners.

Even the cheapest Economy Class fares would earn miles equivalent to 100% of the distance flown.

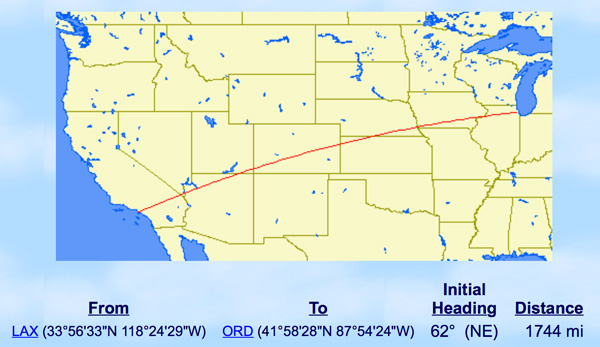

Taking a flight between Los Angeles and Chicago as an example….

…even the cheapest fare you could find would earn 1,744 miles (before any elite bonuses kicked in).

If the passenger had elite status this is what the earnings increased to:

- Gold – 2,180 miles

- Platinum – 3,488 miles

- Executive Platinum – 3,488 miles

That’s a good chunk of miles for a route that you’d often find on sale for around $150 (often a lot cheaper) and it meant that flying was a very good way to boost your miles balance.

Nowadays American Airlines operates a system whereby the number of miles an AAdvantage member earns is based directly on the base cost of the fare…and that’s been very bad news for most of us.

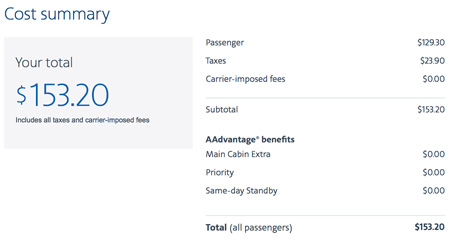

The same LAX – Chicago flight booked today for $153.20 (for example) would come with a “base fare” of $129.30….

…and would earn the passenger 647 miles (5 x the base fare) before any elite bonuses.

…and would earn the passenger 647 miles (5 x the base fare) before any elite bonuses.

If the passenger has elite status this increases to the following:

- Gold – 905 miles

- Platinum – 1,034 miles

- Platinum Pro – 1,164 miles

- Executive Platinum – 1,422 miles

Note: If you’re a flyer who primarily books premium cabin fares (Business/First Class) then this doesn’t apply to you quite so much because, by definition, you’re paying more for your fares and so your mileage earnings will be higher.

The number of miles earned under today’s system can be a LOT lower than in the past and that forms a big part of what I’m going to suggest next.

Try Separating (In Your Mind) The Airline You Fly From The Miles You Choose To Earn

Right now you don’t have to look very far to find a people bemoaning the state of American Airlines (and with good reason) but, although a large percentage of these flyers may not have other viable options (they’re “hub captives), a lot of these disenchanted flyers could quite easily choose another carrier….but they often don’t.

For someone based in LA (for example) the other options open to them are numerous (Delta, Alaska, Southwest etc…) but a lot of LA-based American Airlines flyers don’t seem to be making the most of these options….and that’s crazy.

A lot of flyers that I meet will tell me that they’re throughly fed-up with how American Airlines treats them and, in the same breath, they’ll tell me that they’re stuck with the airline because “all things considered, AAdvantage Miles are still the best loyalty currency to use“.

Sadly these guys are probably right about AAdvantage still having the best currency (despite the numerous devaluations) but I don’t think that should be a reason to continue flying an airline that you actively dislike.

If you like using AAdvantage Miles as your primary currency that’s great but, for most people, flying isn’t the best way to collect miles nowadays….so why confine yourself to an airline you dislike just to earn the miles?

There are numerous credit cards out there that earn American Airlines AAdvantage miles and you can earn more miles by doing your shopping through online portals than you’ll earn on most domestic flights….and quite a few international flights too.

Some of the credit card sign-up bonuses you’ll find on offer will earn more miles than most people can earn in a whole year of flying.

Just because you like a particular airline’s loyalty currency doesn’t necessarily mean you actually have to fly with that airline – earn the miles you love through sign-up bonuses, credit card spend and shopping portals and then use those miles to fly whatever airlines those miles allow you to fly.

Explore Status With Other Airlines

Once you accept that you don’t necessarily have to fly with the airline whose loyalty currency you prefer a host of other options may open up for you.

We’re always hearing how Delta offers a better domestic experience than American Airlines and United (not hard to believe) but we’re also often reminded of how poor SkyMiles (Delta’s loyalty currency) can actually be…but who cares?!

If you’re happy collecting the miles and points you truly value through ways other than flying, why not try out an airline whose reliability and crews appear to be significantly better than the opposition?

I’ve little first hand experience with Delta (although that could be changing soon) but I’ve lost count of the number of times people have told me that their infrequent dalliances with Delta have all offered vastly superior experiences to their more frequent trips on American….so why not fly with Delta a lot more?!

Speaking as someone with top-tier status with American Airlines I can tell you that it isn’t all that it’s cracked up to be if you’re not a heavy spender. In the past Executive Platinum status was nothing short of fantastic while now it’s more “meh” than “marvellous” if you’re not throwing money around.

I don’t believe that AAdvantage airline status is good enough (any more) to keep most flyers from looking elsewhere and, as it’s not that hard to earn AAdvantage Miles outside of flying, there’s little reason not to give Delta (or another airline) a try.

Save Money – Don’t Worry About The Airline You Fly

Based on the conversations I have with people I meet when traveling there are quite a few people who worry about attaining some kind of airline status but who shouldn’t be worrying about it at all.

A lot of the status benefits that people tell me they value can be had for the cost of a credit card’s annual fee (checked baggage allowance, priority check-in, priority boarding etc…) so there’s very little reason to be paying an airline more than you have to (and spending more time away from home than you have to) just to get airline status.

Most people who don’t earn airline status organically don’t fly enough to warrant the cost of airline status in the first place.

If you fall into this category of traveler here’s my suggestion:

- Earn the loyalty currency you prefer through credit cards (sign-ups, spending etc..) and shopping portals.

- Find out which airlines offer the cheapest fares out of your home city to the destinations you visit the most (or would like to visit in the near future)

- Make sure you have one or two credit cards that give you the benefits you consider important on the airlines you’re likely to fly most (based on price and comfort).

- Book your airfares on a combination of price and what is being offered onboard rather than the miles or status you’ll earn.

It May Be Even Easier For You To Earn Miles Without Flying

I selected American Airlines as the example to use in this post for two reasons – it’s the loyalty system I feel most qualified to discuss and it’s the hardest of the three US legacy airline currencies to earn so life should be even easier if you’re looking to collect a different currency.

AAdvantage Miles are one of the few currencies that are not transfer partners for the major credit cards but, if you’re looking to collect the likes of Delta SkyMiles or United’s Mileage Plus Miles, life is even easier.

American Express Membership Rewards Points convert over to SkyMiles in a 1:1 ratio and with cards like the Platinum Card from American Express (5 points/dollar on airfare) and the new Amex Gold Card (4 points/dollar at US restaurants & US grocery stores) it’s easy to rack up a significant number of SkyMiles without too much effort.

Chase Ultimate Rewards convert over to United Mileage Plus in a 1:1 ration and cards like the Chase Sapphire Reserve (3 points/dollar on travel and dining) and the Chase Freedom card (5 points/dollar on spending in quarterly bonus categories) help make collecting United Miles pretty easy.

You don’t have to fly to have a healthy redeemable miles balance.

Bottom Line

Separating out the miles you like to earn and the airline(s) you fly may not be the right thing to do for some readers but for most I suspect it’s the sensible thing to do.

There is little reason for most of us to fly on airlines that treat us poorly and that we dislike as they generally don’t often offer anything we cannot get elsewhere…often with less effort and stress.

If we all fly the airlines that offer a good product a little more and the ones that offer a bad product a little less, perhaps the bad airlines may eventually get the message and do something to improve the truly terrible service that a lot of us have been putting up with for years.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

“Citi ThankYou points convert over to United MileagePlus Miles in a ratio of 1:1 so with cards like …..”

No. You are confusing Citi with Chase

Wow, I have no idea wheee that came from! That’s what happens when you spend a morning thinking about ThankYou points, and then write an unrelated blog post

Thanks for the heads up.

Just want to make sure that isn’t your Barclays Aviator card number info that isn’t obscured for all to see…

Lol! No, it’s a friend’s old card which got cancelled a while back…but I guess I’d better cover up the digits in case they can some how still be used fraudulently. Thanks for pointing it out and clearly paying more attention than I was when I wrote this! 🙂

[…] If anyone is reading this and thinking “yeah…but I get to earn BA Tier Points and Avios if I pay a little more for BA” (I know some of you are thinking exactly that) you should probably read the latter part of this post I wrote a few days ago. […]