TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

Despite being devalued in a number of ways since it was first launched, the Chase Sapphire Reserve® credit card is still a major player in the miles & points world so with the card’s current excellent welcome offer about to be pulled*, I though that I’d take a look at how, despite everything, this remains a card that’s surprisingly hard to replace without making some sacrifices.

With the Chase Sapphire Reserve® credit card charging a $550 annual fee, it’s a card whose usefulness a lot of cardholders review at least once a year, but while some have decided to part ways with the Sapphire Reserve, you only have to take a close look at what the alternatives to the card are, to see why quite a few people continue to keep this card in their wallets.

Replacing the CSR’s earnings

A lot of people hold the Chase Sapphire Reserve® credit card for two key reasons:

- It offers strong earnings on all travel spending and on worldwide dining

- The points that the Chase Sapphire Reserve earns can be transferred across to the World of Hyatt and United MileagePlus

To replace the CSR, any card or cards that take its place have to be able to fulfill both of those functions. No single card can do the job as well as the Chase Sapphire Reserve but two cards acting together can – the Chase Sapphire Preferred® credit card (review) and the Chase Ink Business Preferred® credit card (review).

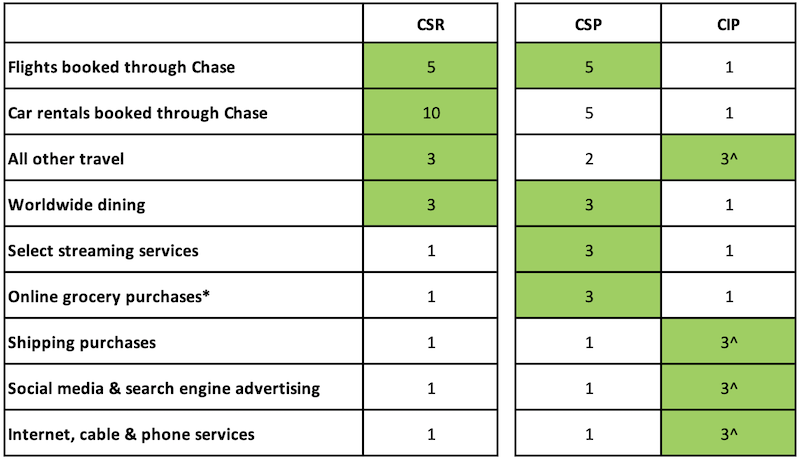

This is what it looks like when you compare the earning rates offered by the CSR to the earning rates offered by a combination of the Chase Sapphire Preferred Card (CSP) and the Chase Ink Business Preferred Card (CIP):

Note: The green highlights show the best earning rates in each spending category

As you should be able to see, the combination of the Chase Sapphire Preferred and the Chase Ink Business Preferred can match or beat the earning rates offered by the Chase Sapphire Reserve in all but one category.

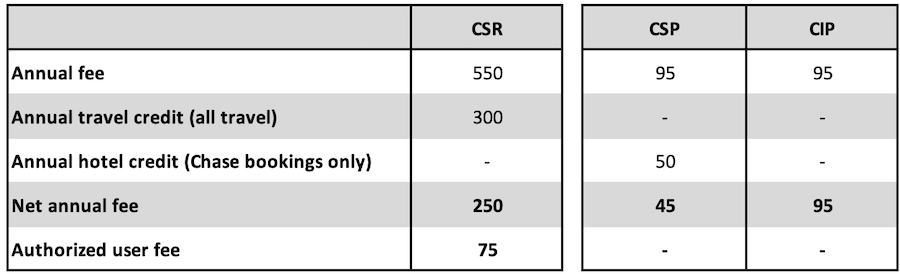

Better yet, when you take a look at what the cost of holding these cards is, the 2-card combination comes out on top.

As the travel credits offered by the Chase Sapphire Reserve® Card and Chase Sapphire Preferred® Credit Card are so easy to use, I’ve assumed that they’re worth face value and so reduced the annual fees accordingly.

This leaves us in a position where the CSR costs $250 to hold (net) and the combination of the CSP and the CIP costs $140 to hold (net).

That’s a nice saving of $110 and because the CSR charges $75 for an authorized user while there’s no charge to add authorized users to either the CSP or the CIP, anyone who wants their friends and family to help them earn more Ultimate Rewards Points will save even more.

If all you care about is the Chase Sapphire Reserve’s earning rates, it’s a card that’s easy to replace.

Unfortunately, while the CSR’s earning rates are attractive, they’re far from the only reason a lot of people have the card in their wallets.

Replacing the CSR’s benefits

A major reason why Chase charges as much as it does for the Chase Sapphire Reserve® Card is that it comes with a variety of useful and valuable benefits.

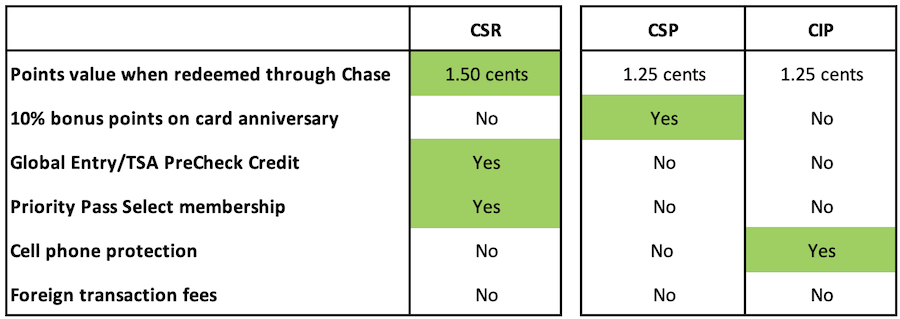

Here’s how some of the key benefits offered by the CSR compare to the key benefits offered by the 2-card combo of the Chase Sapphire Preferred® Credit Card and the Chase Ink Business Preferred® Credit Card:

And here is how some of the key insurances/protections offered by the CSR compare to the insurances/protections offered by the 2-card combo:

The takeaway from all of this is that although the CSP/CIP combo costs $110 per year less than the Chase Sapphire Reserve (net), that $110 buys the following:

- A 20% better redemption rate when Ultimate Rewards Points are used through the Chase Travel portal.

- A Global Entry/TSA PreCheck credit worth up to $100 every 4 years

- Priority Pass Membership (which includes access to PP restaurants)

- Better Trip Delay reimbursement

- Emergency evacuation and transportation cover

- Return protection

That’s quite a lot of good stuff.

For high spenders, the annual points bonus that the Chase Sapphire Preferred® Credit Card offers may move the needle a little way back towards the 2-card combo and the cell phone protection offered by the Chase Ink Business Preferred® Credit Card may move the needle a bit more, but the 2-card combination cannot replace some very key (and very valuable) benefits that the Chase Sapphire Reserve® Card offers.

If you want to continue enjoying Priority Pass membership, a better level of Trip Delay cover, Return protection, a Global Entry Credit, and emergency evacuation and transportation cover, you’re going to need at least one more card… And that may add to your costs.

Ritz-Carlton Card to the rescue?

If you hold the Chase Ritz-Carlton credit card (no longer open to new applicants) and you find that the card pays for itself, you’re doing ok but you’re not doing great.

The Ritz-Carlton card offers the best Priority Pass membership and all the same protections as the Chase Sapphire Reserve, but if you want to actually use the key travel protections you have to make sure that at least part of your flight spending is charged to the Ritz-Carlton card.

Not only does that mean that you’ll no longer earn 3 Ultimate Rewards Points/dollar for the portion of your flight that you charge to the Ritz-Carlton card, but it also means that you’ll have to go to extra effort to split the cost between the Ritz-Carlton Card and, presumably, the Chase Ink Business Preferred Card. That’s far from ideal and far from an easy thing to do.

Will the Platinum Card® from American Express save the day?

If you hold the Platinum Card® from American Express things are a little more straightforward.

The Platinum Card offers 5 points/dollar on up to $500,000 of airfares booked directly with an airline or through Amex Travel (terms apply) as well as a lot of the same travel protections that the Chase Sapphire Reserve offers (it offers better emergency evacuation and transportation cover and slightly worse Trip Delay cover) so as long as you don’t mind giving up 3 Ultimate Rewards Points/dollar when booking flights, things are looking good.

The one negative is that the Priority Pass membership that the Platinum Card gives cardholders doesn’t offer access to Priority Pass restaurants, but if you can live with that and you have no trouble justifying the Platinum Card’s $695 annual fee (rates & fees), you may have yourself a three-card combination that just about covers what the Chase Sapphire Reserve offers… But you’ve still compromised.

Will the Capital One Venture X credit card save the day?

Possibly.

The Capital One Venture X Rewards Credit Card is a very good card as not only does it have an annual fee that should be easy to recoup ($395), but it also offers a good Priority Pass membership (which includes PP restaurants), access to Plaza Premium Lounges, a Global Entry/TSA PreCheck credit, and a lot of the same key travel protections that you get with the Chase Sapphire Reserve Card.

As long as you’re happy booking all your airfare through Capital One (the Venture X Card earns 5 miles/dollar for airfare bookings made through the Capital One portal) this could be the card that, alongside the Chase Sapphire Preferred and the Chase Ink Business Preferred, allows a holder of the Chase Sapphire Reserve Card to give that card up.

If you’re not happy booking all your airfare through a portal (for whatever reason), the Venture X Card will fall down in a similar way to the Ritz-Carlton Card because if want to make the most of all the great travel protections when you fly, you’re either going to have to…

- Accept 2 miles/dollar for your airfare spending instead of 3 Ultimate Rewards Points/dollar or

- You’re going to have to find a way to split your airfare between the Venture X Card and the Chase Ink Business Preferred Card.

As most people who hold the Chase Sapphire Reserve® Card will almost certainly prefer 3 UR points/dollar to 2 miles/dollar, I suspect that only those who are prepared to book airfare through the Capital One Portal will find that the Capital One Venture X Rewards Credit Card is the final card (in a set of 3) that they need to give up the Chase Sapphire Reserve.

The key assumption

To replace the Chase Sapphire Reserve, you’ll need at least one other card on top of the Chase Sapphire Preferred® Credit Card and the Chase Ink Business Preferred® Credit Card to make sure that you cover most of what the CSR offers.

The assumption that allows this to be a reasonable way of replacing the CSR is that the net cost of all of those cards doesn’t exceed $250.

With the Capital One Venture X Rewards Credit Card that shouldn’t be too much of an issue and I find that the Ritz-Carlton Card can earn its annual fee back reasonably easily too, but with the Platinum Card® from American Express, that’s not a forgone conclusion.

Yes, I know a lot of people claim to be able to get all of the Platinum Card’s annual fee back through the various benefits that the card offers, but the fact is that those people are in a minority.

For considerably more people, holding the Platinum Card will come at a cost and that cost could easily make the Platinum Card an uneconomical option as part of a CSR replacement plan.

I gave up the Chase Sapphire Reserve Card

At this point, it’s only right to point out that I gave up my Chase Sapphire Reserve® credit card last year, so I’m not trying to suggest that that it’s irreplaceable or that it is a must-have card for all miles and points fans. It isn’t.

I am, however, in a different position to most in that I hold all but one of the cards that I mentioned above – I hold the Chase Sapphire Preferred® credit card, the Platinum Card® from American Express, the Ink Business Preferred® Card and the Ritz-Carlton credit card – and thanks to my travel and work patterns, I can justify all the annual fees that these cards charge.

I didn’t so much “replace” the Sapphire Reserve as decide that if I downgraded it to the Sapphire Preferred card (an excellent card in its own right), I would still have all the firepower that I need in my credit card portfolio and so it would be silly to continue paying the CSR’s annual fee.

Bottom line

To replace the Chase Sapphire Reserve® credit card you’ll have to be happy to give up the ability to redeem Chase Points at 1.5 cents each through the Chase Travel portal, you’ll probably have to compromise a bit on the travel protections that you end up with, you’ll have to make sure that you don’t inadvertently end up paying more to replace the CSR than you would have paid to retain it, and you will need to hold at least three other cards to do get the job done.

It’s definitely possible to replace the Chase Sapphire Reserve Card, but because no one other card can fully match what the CSR offers, deciding what to replace it with isn’t straightforward.

Note: I’m aware that other card combinations exist that may/could replace some/most of the CSR’s benefits, but I think the main contenders are mentioned above.

*New successful new applicants for the Chase Sapphire Reserve® credit card can currently earn 80,000 bonus points (valued at $1,200) when they spend $4,000 on purchases in the first 3 months after account opening. This deal will be pulled at 09:00 on 1 December 2022 (details).

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)