TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

UPDATE: Some or all of the offer(s) mentioned in this post have now expired

Where Hollywood has its awards season, I have a card applications season and as I mentioned the other day, I’m in the middle of application season right now and I intend to make it a good one.

Last year’s season was a total flop, but a little patience and luck have helped me get this season off to a flying start with a successful application for the one card that I’ve been after for a very long time.

The background

I’ve wanted the card_name (review) for as long as the card has been around, but a combination of bad timing, indifferent welcome bonuses (not recently), and a concern that Chase wasn’t going to take the application seriously and decline me, had all kept me from trying to get the card.

By last fall, however, I had been building up a new business for a couple of years and I felt confident that it was the right time to submit an application.

As I’ve said before, it would be more than a little disingenuous of me if I didn’t admit that the massive 100,000 point welcome offer that the card_name has been offering for a while didn’t play into my decision to apply for the card, but the welcome bonus was far from being the only reason the card appealed to me.

I needed a new business credit card to help me keep the spending of my newest business separate from my other business spending, and the earning rates and select benefits that the card_name offers make it the perfect card to use for the new business. Applying for this card had never made more sense.

My 2020 application season

Last year, I said that I had three cards on my shopping list, and applications season 2020 got off to a good start when I was approved for the card_name (review) without too much drama.

There was no instant approval, but after I moved my credit lines around, Chase was happy to give me what has turned out to be a very useful card to hold and one I’m delighted I have (Hyatt seems to like targeting World of Hyatt cardholders for bonus points and promotions).

From that high point, things went downhill disappointingly quickly.

My plan had been to apply for the card_name next, and to then follow that up with an application for the card_name (review) 45 days later (what can I tell you? I love Ultimate Rewards Points).

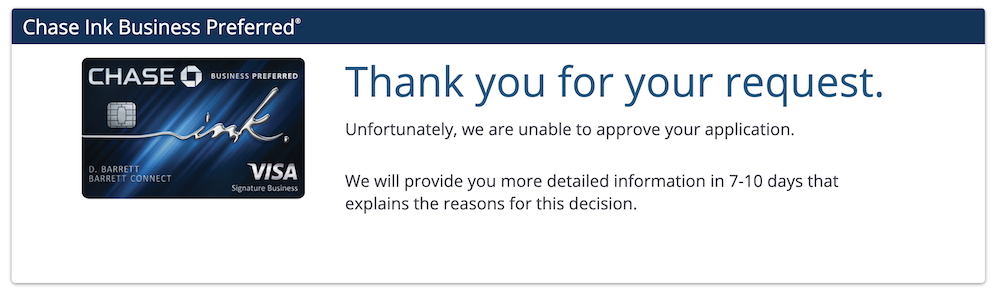

Unfortunately, that plan crumbled the moment that Chase decided that my 800+ credit score wasn’t good enough to get the card_name and I couldn’t get the reconsiderations team to change their mind.

Chase’s reason for declining the application was that it couldn’t verify that I had a business to justify the Ink card (the business is a sole proprietorship), but as I could point to two years of accounts and tax filings, that clearly wasn’t the real reason I was declined.

I’m pretty sure that in the fall of 2020, Chase was still in full-on “must take no risks” pandemic mode, and that it wasn’t approving any business card applications that weren’t absolutely bulletproof (in its mind), and this put me off from following up the Ink Card application with my planned application for the Freedom card – I was annoyed at having taken one hit to my credit score with nothing to show for it, so I wasn’t about to risk a second.

At that point, I decided to sit out the rest of my application season and I wasn’t planning to do anything to persuade Chase that my newest business deserves an card_name until a very tempting offer fell into my lap.

Chase gave me an idea… and cash

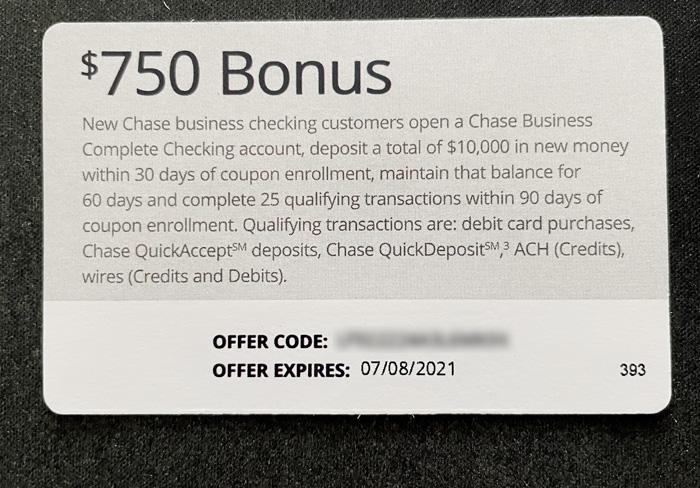

Earlier this year, Chase sent me an email as well as a mailer in the post offering me a $750 bonus in return for opening up a business checking account and hitting a few targets.

Specifically, to earn the bonus I had to keep $10,000 on deposit in a new business account for 60 days and I had to push 25 transactions through the account (ACH credits or debit card charges) within 90 days of account opening.

I hadn’t planned on opening a new business checking account, but what better way to prove to Chase that I have a real business than by opening up a Chase checking account for that business and letting the back see the business trade?

The $750 bonus (which was the easiest cash that I’ve ever earned) was just the cherry on the top.

My 2021 application season (so far)

I’ve had my business checking account up and running for over 4 months, so as I entered my 2021 application season, I knew that Chase had some reasonably good evidence that I had a genuine business and a verifiable need for the card_name.

All that I now had to do was to decide when to apply.

Should I apply early and hope that I don’t get turned down again and ruin a second application season in a row? Or should I apply late and risk my other applications giving Chase a reason to decline me for a second time?

I knew that I wanted the card_name more than any other card that I have in my sights, so I decided that to give myself the best chance of having an application succeed, it would have to be the first application that I made this year.

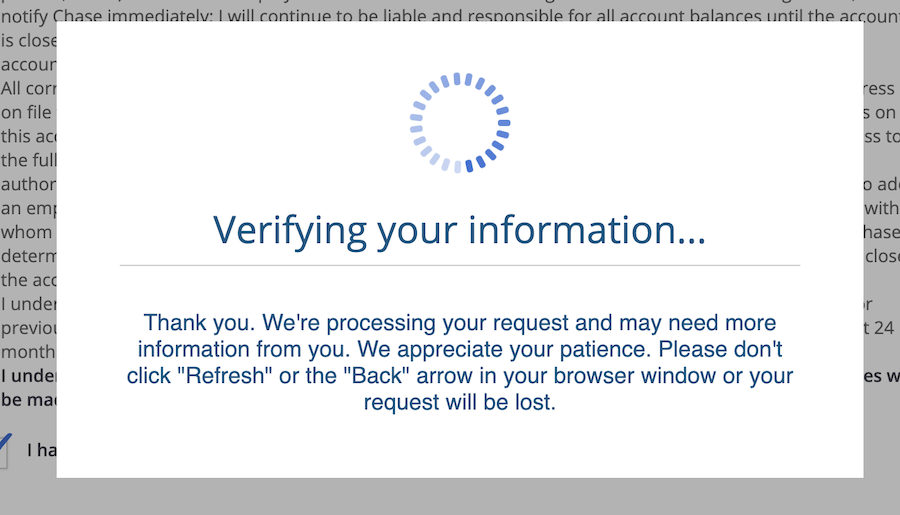

I pulled the trigger on the application a few days ago and after waiting for what seemed like an eternity while Chase verified the information I had submitted…

…a screen I genuinely wasn’t expecting to see appeared.

…a screen I genuinely wasn’t expecting to see appeared.

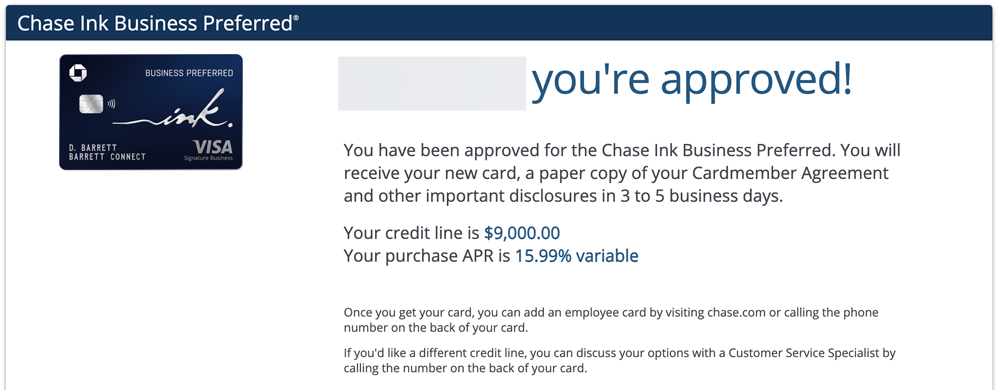

Before I submitted the application I thought that I had a pretty good chance of being approved eventually (I wouldn’t have applied otherwise), but I was also pretty sure that it would take some negotiating with Chase and some more moving around of my credit lines.

An automatic approval was completely unexpected.

Locking in the welcome bonus

I now have 90 days in which to lock in the 100,000 point welcome bonus by putting $15,000 of spending on the card within that time frame, and that’s not going to be a problem at all

(Note: The welcome bonus on this card has been updated to offer 100,000 bonus points when a new cardholder spends just $8,000 on their card in the first 3 months of card membership).

There’s a reason that I consider this time of year my “application season” and it’s because my organic spending always skyrockets around now, making it the perfect time to apply for credit cards and to earn their welcome bonuses.

Better yet, because this card’s earning rates dovetail so nicely with my business, all of the spending that I’ll be putting on the card_name to earn the welcome bonus will be made in categories in which it offers enhanced earning rates.

Not only will I earn 100,000 Ultimate Rewards Points for hitting the welcome bonus spending target, but I’ll also earn a further 45,000 Ultimate Rewards Points along the way.

As I value Ultimate rewards Points at 1.5 cents each (based on the value I know that I can get out of them with next to no effort), the card_name will effectively give me over $2,100 worth of Ultimate Rewards Points in the first few months that I hold it, and that’s the kind of return that makes the miles and points game so worthwhile (and fun!)

Bottom line

My failed attempt to get the card_name last fall effectively put an end to my 2020 application season, so to get approved for the card with no reconsideration call and no need to move around credit lines, is a great way to get my 2021 season started.

To play it safe I’m going to hold off making any more applications for a few weeks, but then it will be time for application number two and I’ll report back how that goes when the time comes – I’m hoping for no dramas but with the banks being as they are, that’s far from guaranteed 🙂

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)