TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Foreign transaction fees are the bane of every traveler’s life – they’re unnecessary and they make everything cost that little bit more when you’re abroad. For those wondering what these fees are allow us to explain:

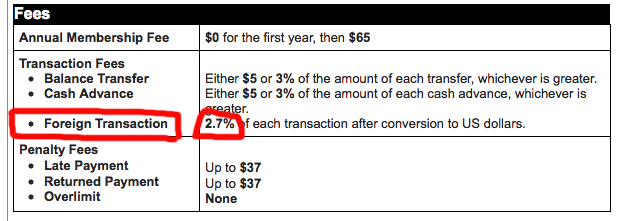

When you use your credit card abroad there is a very good chance that your credit card company will charge you extra for any transactions that you make – typically they’ll add on between 2-3% of the transaction value to your bill. Just think about that for a second. Every time you use your credit card abroad you could be being charged 3% more than you should be paying. It’s a rip off! The credit card companies are already make a profit on your foreign purchases by adjusting the exchange rate you’re given so why allow them to make even more money with these fees?

Let’s put this another way: How would you feel if your state sales tax went up by 2-3%? Or how about your income tax? You’d probably find those increases pretty unacceptable wouldn’t you? So don’t fall into the trap of paying these fees when you’re shopping abroad.

You can find out if you’ll be stung for these fees on your next trip by simply checking the fees section of your credit card agreement. If you haven’t got a copy to hand (most won’t!) you can find the terms & conditions online.

The good news is that, unlike with taxation, there is no reason for a traveler to ever have to pay these fees. If you’re a resident of the US there are a lot of credit cards that now offer “No Foreign Transaction Fees” as part of their package of benefits and you can find a good list here.

When looking through the list be mindful of the fact that not all the cards offer the same benefits so make sure you choose one that matches your own personal circumstances. Some cards have an annual fee but also offer other benefits such as loyalty points, premium rental car insurance etc. (the Chase Sapphire Preferred card would be a good example here) while others have no annual fee but have less perks associated with them (some of the Capital One cards fall into this category). Our two favourites are the Bank Americard Travel Rewards Card and the Barclaycard Arrival World Mastercard neither of which charge an annual fee and both of which have some nice benefits that go along with them. (Note: we are in no way affiliated to any of these card issuers and receive no compensation for mentioning their products – we just happen to think that some of them are good. Do your own research!).

Also, be aware of your own spending habits and finances. If you’re someone who carries a balance on their credit card then shopping for a card with a low APR will probably be more beneficial to you than a card with great benefits but high APR. Don’t exchange one set of fees (foreign transaction fees) for another set (interest).

If you’re one of our UK users then your choices are more limited. Credit cards with no foreign transaction fees are still relatively new in your area but they do exist.

The uSwitch Website has a list of the ‘travel abroad” UK credit cards but be careful to sort by the “worldwide usage fee” column as not all the cards in that list have zero foreign transaction fees. As with the US credit cards it’s important to understand what is best for your particular situation – the top Lloyds cards look attractive for Avios collectors but not if you carry over a balance at the end of each month – that 50.8% APR is a killer!

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)