TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

Citi is emailing out customers with a slightly improved sign-up offer on the Citi AAdvantage Platinum Select World Mastercard but the nature of the offer means that not everyone who’s in the market for this card will want to take it up – it will suit some more than others.

The Citi AAdvantage Platinum Select World Mastercard

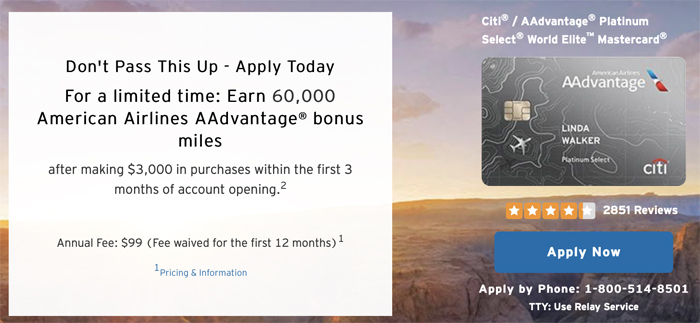

The current sign-up offer on the Citibank webpage is for 60,000 bonus AAdvantage miles after making $3,000 in purchases within the first three months of account opening…..

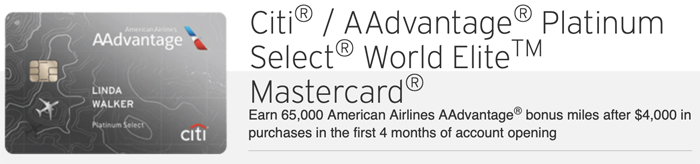

…while the offer being emailed out to targeted individuals is for 65,000 bonus AAdvantage miles after making $4,000 in purchases within the first four months of account opening:

You’ll earn an extra 5,000 miles if you’re prepared to put $1,000 more spend on the credit card….and Citi will give you an extra month in which to do this.

The card comes with a $99 annual fee which waived in the first year regardless of which of the two sign-up offers you accept.

Earnings

- 2 AAdvantage Miles/dollar spent with American Airlines

- 2 AAdvantage Miles/dollar spent on dining

- 2 AAdvantage Miles/dollar spent at gas stations

- 1 AAdvantage Miles/dollar spent everywhere else

Benefits

- First checked bag is free for the primary card holder and up to four companions traveling on the same reservation.

- Priority boarding

- 25% discount when the card is used to buy food and drink on board American Airlines

- Earn a $125 American Airlines Flight Discount after you spend $20,000 or more in purchases during your card membership year and renew your card.

- No foreign transaction fees

Thoughts

While it’s hard to get excited about a card which only offers 2 miles/dollar for travel on American Airlines (when the likes of the Amex Platinum and Citi Prestige offer 5 points/dollar) it’s worth remembering that none of the major transferable currencies convert over to American Airlines.

If you want to earn American Airlines miles from credit card spend there aren’t all that many great options out there and, at the $99/year level, this is about as good as it gets.

The free checked bag benefit can be useful if you don’t have American Airlines status and if you tend to book Economy Class fares the 25% discount on onboard food & drinks purchases can help partially offset the annual fee (if you decide to hold it past the first year) but I suspect that most people’s interest in this card will be courtesy of the sign-up bonus.

I value AAdvantage Miles at just 1.25 cents each so the bonuses on offer are equivalent to a rebate of $750 or $812.50…and that’s not bad for a card that’s free to hold in the first year.

Are You Eligible?

This is the significant paragraph in Citi’s terms and conditions:

American Airlines AAdvantage® bonus miles are not available if you have had any Citi® / AAdvantage® card (other than an AAdvantage MileUpSM or CitiBusiness® / AAdvantage® card) opened or closed in the past 24 months.

If those conditions don’t affect you then you should be clear to earn whichever sign-up bonus works best for you.

If you haven’t been targeted for the increased bonus and it’s a bonus you’d like to go for then I suggest you call up Citi to see if the improved offer can be added to your account.

Bottom Line

If you’ve been targeted for the 65,000 bonus you’ll need to decide just how easily you’ll be able to spend the extra $1,000 required to earn the sign-up bonus and you’ll also need to take into account where that spend will come from.

For people who can easily manufacture spending or who have a lot of outgoings the higher sign-up bonus will probably make sense….but for others this may not be the case.

$4,000 is a lot of money to spend in 4 months when a lot of people’s largest outgoings generally aren’t ones which can be can be paid with a credit card so, if it looks like it may be a stretch, don’t try to force things for the sake of an extra 5,000 AAdvantage miles. Settle for the 60,000 miles and accept that you made the right decision for your circumstances.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

Hello,

Question, is the 65,000 Points Sign-Up Bonus still active today? If yes can you let me know where I can find it? I can’t find it anywhere.

I don’t appear to have the email anymore so, unfortunately, I don’t think I can be of much help.