TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

There are two IHG One Rewards co-branded consumer credit cards that are currently open to new applicants and while the premium card usually gets most of the attention, this post focuses on the less discussed card_name which is currently offering a great welcome bonus and which gives cardholders one of the most valuable IHG Rewards benefits around.

The card_name

In brief

The card_name is the entry-level annual_fees annual fee IHG One Rewards credit card that can be incredibly useful for travelers who (a) love to redeem points for free night stays at IHG properties around the world and (b) who don’t make a significant number of paid stays with IHG.

In detail

Here’s what you need to know about the card_name:

Annual fee:

annual_fees

Cost of authorized user cards:

$0

Current welcome bonus:

bonus_miles_full (More Details)

Are you eligible?

This product is not available to current cardmembers of any IHG Rewards personal credit card, or previous cardmembers of any IHG Rewards personal credit card who received a new cardmember bonus for that credit card within the last 24 months.

Also, as this is a Chase-issued credit card, if you have opened 5 or more new credit cards in the past 24 months there is a strong chance that you will not be approved for this card.

Earnings

- Up to 17 points/dollar on spending at IHG Hotels & Resorts worldwide*

- 3 points/dollar on spending at gas stations

- 3 points/dollar on spending on utilities

- 3 points/dollar on spending at restaurants

- 3 points/dollar on spending on select streaming services

- 2 points/dollar on spending in all other categories

*Includes 5x earnings from this card, 10x for being an IHG One Rewards member, and 2x for holding Silver Elite status (a benefit of this card).

Key benefits:

- Get the 4th night free on IHG award bookings of 4 nights or more

- Save 20% on points purchases*

- No foreign transaction fees

- Silver Elite status

- Gold Elite status after spending $20,000 on the card in a calendar year and making one additional purchase.

*Does not apply when IHG One Rewards is selling points at a discount

Why this is a great card

The welcome offer

Based on how much value I can easily (i.e. without much effort) get out of my IHG One Rewards balance, I value IHG points at 0.4 cents each and this means that I value the 80,000 bonus points from the welcome offer at $320.

That’s $320 from a card that charges a annual_fees annual fee so, as long as you never carry a balance on this card and get charged interest (no one should ever carry a balance on an interest-bearing travel rewards card), this could be considered to be a very nice gift.

For those who prefer to look upon the points from the welcome bonus in terms of free nights, the points bonus that the card_name is currently offering can be used to book one or more free nights at a variety of IHG’s properties around the world and, thanks to dynamic award pricing, it may even be possible to book more free nights than that during quieter times at some great IHG properties.

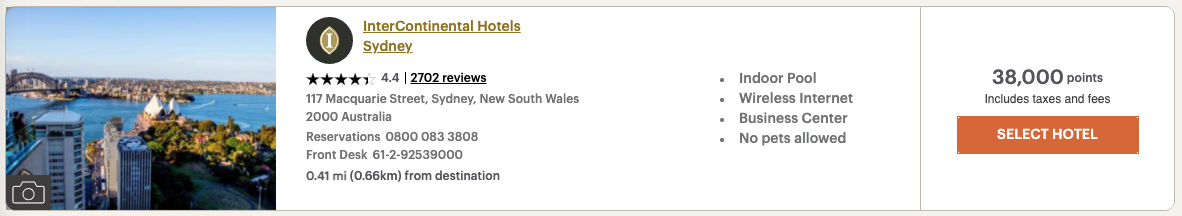

Here’s the InterContinental Sydney priced up at 38,000 points per night:

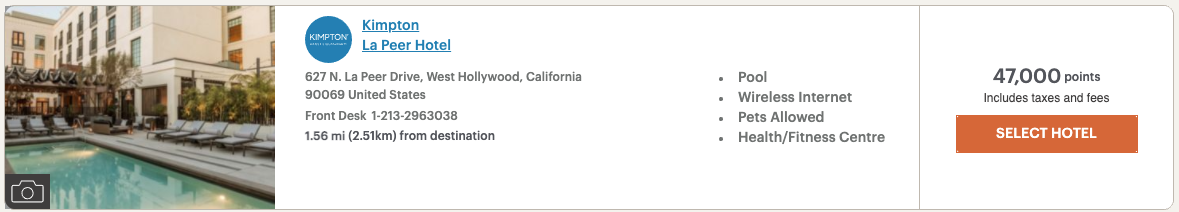

Here’s the Kimpton La Peer in West Hollywood charging just 47,000 points per night:

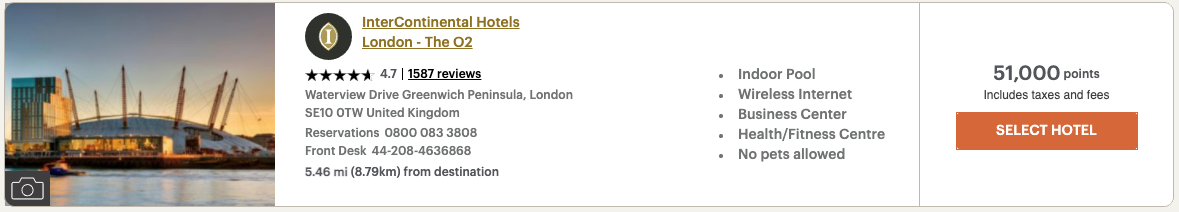

Here’s the InterContinental O2 London charging just 51,000 points per night:

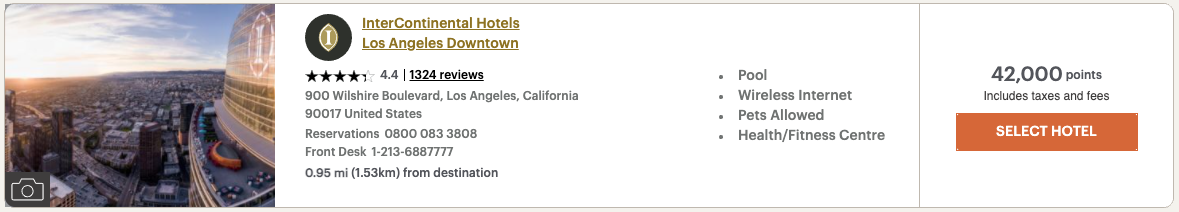

And here’s the InterContinental Los Angeles Downtown charging just 42,000 points per night:

With very little effort, anyone who earns the welcome bonus should be able to book a free night at a lot of top IHG properties around the world regardless of the time of year.

Note: Be careful not to fall foul of any “resort fees” that more and more properties are now charging.

The 4th-night free benefit

Here are the key aspects of this benefit:

- Every 4th night of an award booking is free (so, for example, an 8-night stay would see a cardholder get two free nights).

- There is no cap on the number of times this benefit may be used.

- The is no cap on the points value of the award booking (this can be used at top-tier IHG properties worldwide).

- This benefit cannot be used in conjunction with Points & Cash bookings.

When you consider that on a single 4-night stay this credit card can save a cardholder up to 100,000 points, and when you consider that there’s no cap on how often this benefit can be used, the value of holding this credit card becomes obvious.

If you accept the value that I attribute to IHG One Rewards points (0.4 cents – discussed earlier), the card_name could be said to be able to save a cardholder up to $400 worth of IHG Rewards Points in a single 4-night stay (assuming the stay is at a property charging 100,000 points per night).

That’s not bad for a card that comes with a annual_fees annual fee!

An alternative card

For anyone who pays to stay at IHG properties with any great frequency, the card_name (review) may be a better all-around choice.

This card is currently offering successful new applicants the following welcome bonus:

bonus_miles_full (more details)

It comes with an annual fee of annual_fees, it earns twice as many points for stays at IHG properties (10 points/dollar), and it bestows IHG One Rewards Platinum Elite status on the cardholder for as long as the card is active.

Bottom line

The card_name is currently offering a good welcome bonus, it comes with a annual_fees annual fee, it doesn’t charge foreign transaction fees, and it can save cardholders a substantial number of points when they make the most of its 4th night free benefit.

If you like booking award stays at IHG properties, but you don’t pay to stay at IHG properties often enough to warrant paying for the more premium credit card (which also offers this benefit), the annual_fees annual fee IHG Rewards Traveler credit card would be a great addition to your wallet.

Featured image courtesy of IHG

Currently, successful new applicants for the

Currently, successful new applicants for the

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

I helped my daughter get this card…..good for 8 days in Gulf

Shores Alabama if she plays her cards right.