TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

The card_name is a fantastic card to hold if you’re a fan of IHG properties as not only does it currently come with a fantastic welcome offer, but it also offers cardholders a number of key benefits that can improve their stays with IHG and, crucially, save them money and points.

The card_name

Here are some key things you need to know:

Annual fee

annual_fees/year

Welcome bonus

bonus_miles_full (link to more details).

Note: This product is not available to current cardmembers of any IHG Rewards personal credit card, or previous cardmembers of any IHG Rewards personal credit card who received a new cardmember bonus for that credit card within the last 24 months.

Earnings

- 10 points/dollar on spending at IHG properties worldwide

- 5 points/dollar on spending at restaurants

- 5 points/dollar on spending at gas stations

- 5 points/dollar on travel spending

- 3 points/dollar on spending in all other categories

IHG One Rewards members using this card to pay for stays at full-service IHG properties will earn 26 points/dollar on all IHG spending during their stay (earnings at some limited service properties are lower).

The 26 points/dollar earnings are broken down as follows:

- 10 points/dollar for using the card_name to pay for your spending

- 10 points/dollar for being an IHG One Rewards member

- 6 points/dollar for being an IHG One Rewards Platinum member*

*The card_name offers IHG One Platinum elite status as one of its benefits

Key benefits

- Get a certificate of a free night at properties costing up to 40,000 points/night every year. The certificate can be topped up with points for more expensive bookings.

- IHG One Rewards Platinum elite status for as long as the card is held

- Get the 4th night free on IHG award bookings of 4 nights or more

- Global Entry or TSA PreCheck or NEXUS credit of up to $100 every 4 years

- $100 statement credit and 10,000 bonus points after a cardholder spends $20,000 and makes one additional purchase each account anniversary year.

- United MileagePlus members get up to $50 in TravelBank credits every year.

- Save 20% on points purchases*

- No foreign transaction fees

*Does not apply to IHG One Rewards points sales

What makes this card great

The welcome bonus

Based on how much value I can get out of my IHG Rewards balance with ease, I value IHG points at 0.4 cents each, so this means that I value the 140,000 bonus points from the welcome offer at $560.

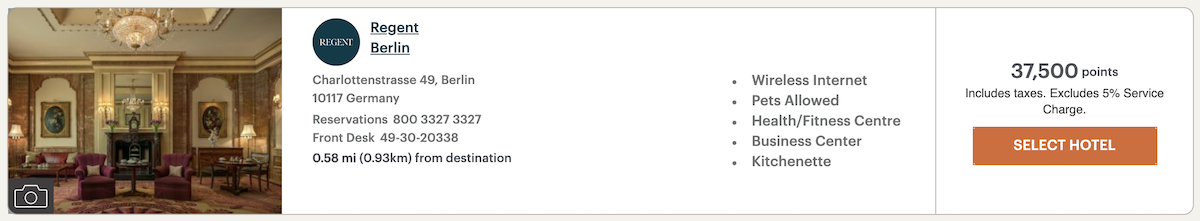

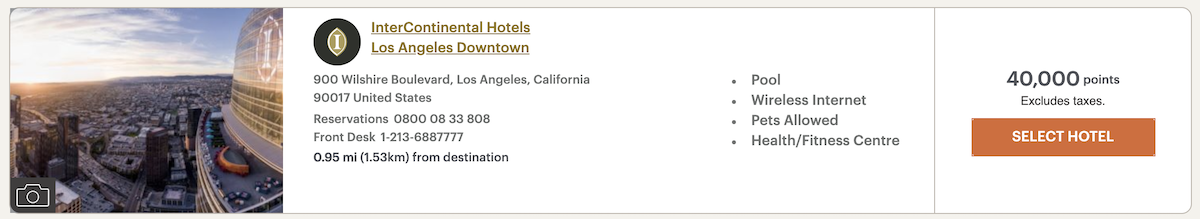

For those who prefer to look at the points in terms of free nights, the bonus points that the welcome offer is currently publicizing can be used to book at least two nights at a variety of top IHG properties around the world.

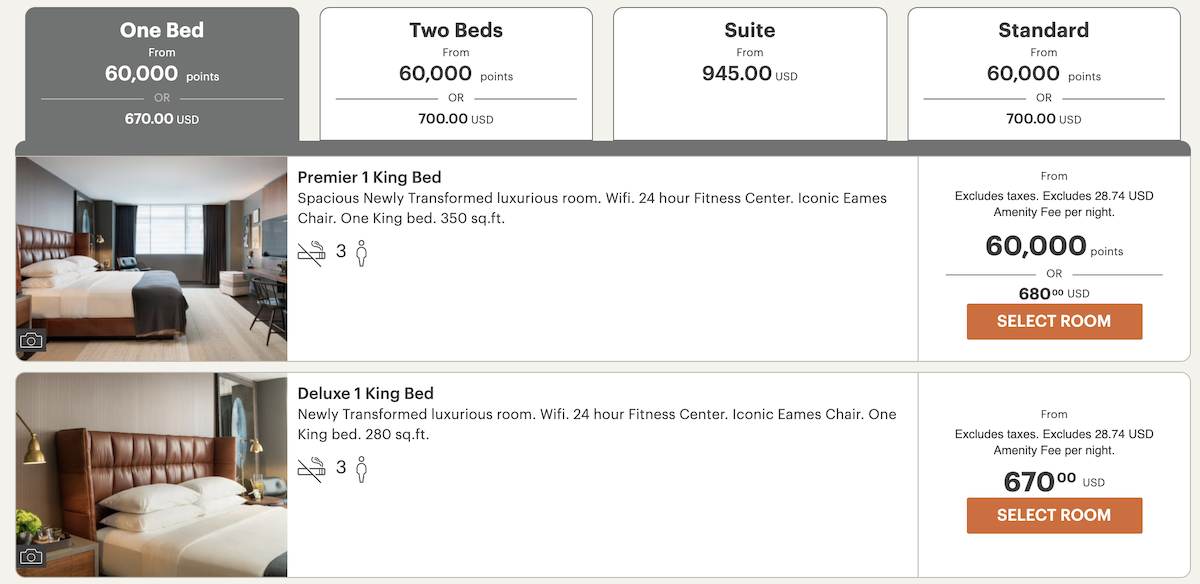

Most of IHG’s top-tier properties cost 80,000 – 120,000 points per night during busy times (so the welcome offer would cover between one and two nights when cash rates are high), but thanks to dynamic award pricing you should find that a lot of excellent hotels can be booked for a lot less than that.

The 4th night free on award bookings

This is a benefit that, on its own, should easily cover the annual fee charged by the card_name.

Here are the key aspects of this benefit:

- Every 4th night of an award booking is free (so an 8-night stay would see a cardholder get two free nights).

- There is no cap on how many times this benefit may be used

- The is no cap on the points value of the award booking (this can be used at top-tier IHG properties worldwide)

- This benefit cannot be used in conjunction with a Points & Cash booking

When you consider that on a single 4-night stay this benefit can save a cardholder up to 120,000 points (the current maximum cost of most IHG top-tier properties) and the fact that there’s no cap on how often this benefit can be used, the annual_fees annual fee looks like a bargain if you’re a fan of IHG One Rewards.

At 0.4 cents/point, this benefit will save a holder of the card_name up to $480 on a 4-night stay and even if the stay is made at a time when award costs are cheap (e.g. when you can book a great InterContinental for 40,000 points/night), the saving will still be close to double the card’s annual fee.

Annual free night award

Every year on or around their card anniversary, holders of the card_name are given a certificate valid for a free night at properties costing up to 40,000 points per night. On its own, this benefit may not be valuable enough to book IHG’s top-tier properties during busier times, but with IHG now permitting members to add points to bookings made with these certificates, the certificates can be used to, effectively, reduce the cost of most award booking by 40,000 points. This makes them more valuable than ever before.

Also, as IHG uses dynamic award pricing, cardholders should be able to find dates (during quieter times of the year) on which they can book some truly excellent properties without having to top up their certificates with points:

Dynamic award pricing can be irritating, but it can also definitely help holders of the card_name get excellent value out of their annual free night certificate.

United TravelBank credits

On or around 1 January and 1 July every year, a $25 TravelBank card_name is issued to cardholders who have linked their United MileagePlus number to their IHG Premier Card (here).

Credits issued in the first half of the year will all expire on 15 July of the same year and those issued in the second half of the year will expire on 15 January of the following year.

If you’re someone who books at least one United Airlines revenue flight every six months, you’re effectively being given a $50 rebate on those flights every year and that will, effectively, reduce the Premier Card’s annual fee to just $49.

If, however, you’re not a big United Airlines flyer, this will only be a benefit that’s of any consequence every now and again so it cannot be used to effectively discount the cost of the card’s annual fee.

Final thoughts

The points I made above are the key reasons why I think this card can be a good addition to an IHG fan’s wallet and I’ve deliberately shied away from discussing some of the other benefits because, on the whole, they’re not particularly impressive.

I’m not going to suggest that anyone should be spending $20,000 on this card just to earn the $100 credit + 10,000 bonus points that are on offer (if you can spend that much at IHG properties that’s fine, otherwise there are a lot of other credit cards that will offer you a better return on your other spending).

I’m not going to suggest that IHG One Rewards Platinum status is amazing (I have it, and I can tell you that while it’s definitely better than it was before the recent refresh, it still isn’t a super-exciting elite status).

I’m not going to suggest that anyone should be spending $40,000 on this card just to earn IHG One Rewards top-tier Diamond status (if you can spend that much at IHG properties that’s fine, otherwise, as I mentioned a few sentences ago, there are a lot of other credit cards that will offer you a better return on your other spending).

And I’m not going to suggest that the 20% saving on points purchases is a great deal as the discount isn’t available on sale pricing and you should never buy IHG Rewards points outside of a sale.

What I will suggest, however, is that the card_name is a must-have card for anyone who pays to stay at IHG properties with any great frequency – the card should more than pay for itself year after year.

Bottom line

If you stay at IHG properties with any great frequency you would be well advised to have an IHG co-branded credit card in your wallet and with a great welcome offer and a host of excellent benefits to make your IHG stays better and cheaper, the card_name is probably the card you should hold.

Link to more info and details of how to apply

Featured image courtesy of IHG

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

So I can’t get this card if I still have Chase’s IHG $49 annual fee card?

Correct