TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

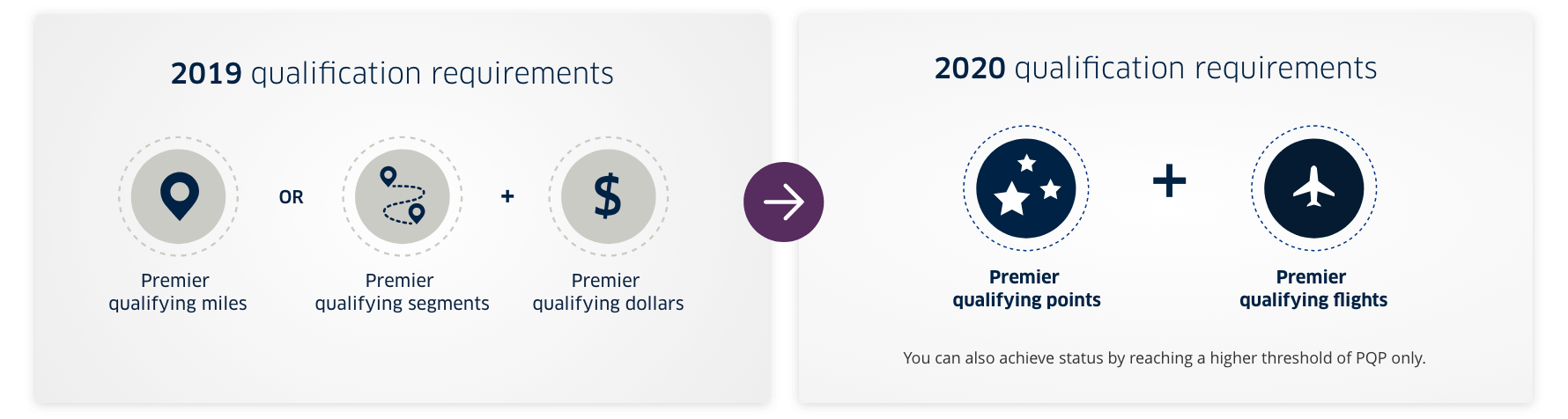

United Airlines has announced big unexpected changes to its MileagePlus program and how you view these changes will very much depend on your travel patterns, the nature of the trips you take and how much you pay for your trips. The way status is earned on United just changed completely.

Click the links to skip ahead to the relevant section:

- United MileagePlus changes (In Brief)

- United is changing how status is earned (what are PQP and PQF?)

- Earning PQP with United

- Earning PQP with United’s partner airlines

- Earning PQP with credit card spending

- What are Premier Qualifying Flights (PQF)?

- Thoughts

- Bottom Line

United MileagePlus Changes (In Brief)

All changes apply to the qualification period starting 1 January 2020

- Premier Qualifying Dollars (PQM) are being renamed Premier Qualifying Points (PQP)

- The distance a MileagePlus member travels is being eliminated from the Premier status qualification requirements.

- To earn status a traveler will now have to fly a minimum number of segments and earn a minimum number of Premier Qualifying Points (PQP) in a qualification year.

- The number of PQP required to earn status is increasing for all status levels

- PQP will now be awarded on more types of spending with United as well as on flights booked through partner airlines.

- MileagePlus members based outside the US will no longer get a PQP exemption.

- Chase United co-branded credit cardholders will no longer be able to earn a PQP exemption for the lower status tiers.

- Chase United co-branded credit cardholders will no longer see the 4-segment minimum requirement (to earn status) waived.

United Is Changing How Status Is Earned

If you thought that the introduction of minimum spend requirements and fare-based mileage earning was revolutionary you’re in for a surprise when you see what United has now announced.

From 1 January 2020, the distance traveled by a MileagePlus member will have a lot less bearing on the status the member can earn that it has in the past.

United is changing the qualification criteria for Premier status so that it will now be earned in one of two ways:

- Taking a minimum number of flights and spending a minimum amount of money with United and its partner airlines or

- Significantly exceeding the spending requirement of the status level you’re aiming for.

Premier Qualifying Dollars (PQDs) will now be called Premier Qualifying Points (PQPs) and the flights needed to qualify for status will be called Premier Qualifying Flights (PQFs).

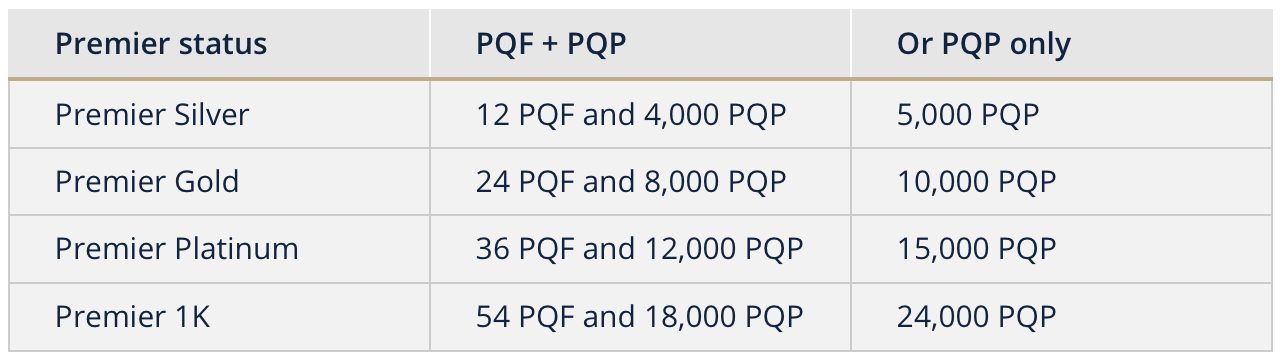

With all that in mind, these are the new requirements for earning United MileagePlus status for the qualification period starting on 1 January 2020:

The amount you have to spend (PQP) is increasing for all status levels, although the effect that this has will be partially offset by the fact that PQP can be earned in more ways than the old Premier Qualifying Dollar were earned.

Earning PQP With United

From 1 January 2020 United will no longer waive the spend requirement for MileagePlus members with international addresses so the information below applies to all members.

Premier Qualifying Points (PQP) are essentially the same thing as the outgoing Premier Qualifying Dollars (PQD) except that they can now be earned on more types of spending than before.

From 1 January 2020 PQP will be awarded on the following spending:

- Base fare + surcharge (including Basic Economy fares)

- Economy Plus seating purchases (includes subscriptions)

- Preferred seat purchases

- MileagePlus Upgrade Award co-pays*

- Paid upgrades*

*Indicates a new option

Earning PQP With United’s Partner Airlines

Update 28 April 2020: United has announced a change to how many PQP can be earned from flights booked through partner airlines (click here for more details)

As things stand, flights booked through United’s StarAlliance partners do not count towards the minimum spending requirements for each status level but from 1 January 2020 that will change.

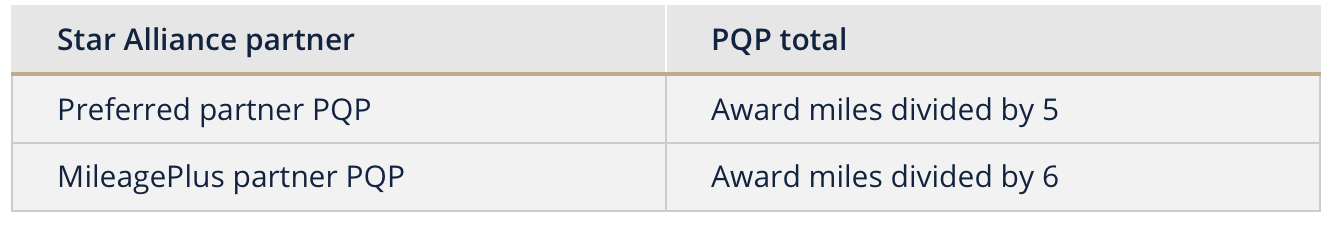

United has divided up its airline partners into “Preferred Partners” and “MileagePlus Partners” and will award PQP on flights booked through these airlines based on the miles those partners award.

Here’s how United defines “Award Miles”:

[A]ward miles is your base award miles earning plus your fare class bonus award miles earning, if eligible. Premier bonus miles earned are not included within this calculation and are ineligible for Premier qualifying points accrual.

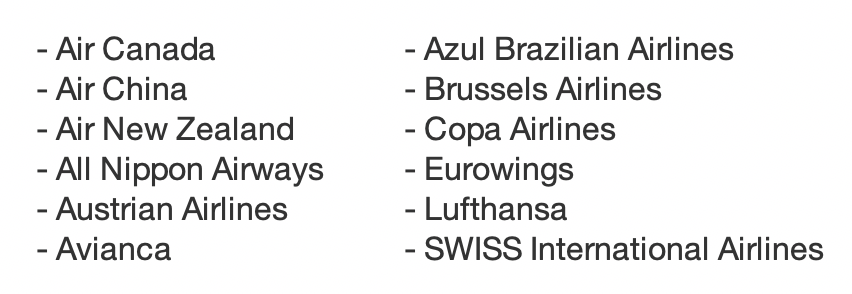

United’s Preferred Partners:

United’s MileagePlus Partners:

The example that United gives is that if you earned 360 award miles for your flight, you’ll receive 72 PQP if you flew with a preferred partner, and 60 PQP if you flew with a MileagePlus partner.

Earning PQP With Credit Card Spending

From 1 January 2020 Chase card members who, up until now, have been able to earn Premier Qualifying Dollar waivers (for select status levels) by spending heavily on their credit card will no longer be able to do the same with PQP.

In place of the waivers, Chase cardholders will be able to earn up to 3,000 PQP through credit card spending.

Per United:

- The UnitedSM Explorer Card, United ClubSM Card, UnitedSM Explorer Business Card, United ClubSM Business Card, United MileagePlus® Awards Card, United MileagePlus® Card, and United MileagePlus® Business Card earn 500 PQP for every $12,000 in card spend, up to 1,000 PQP in a calendar year, that can be applied up to Platinum.

- The United MileagePlus® Select Card and United MileagePlus® Platinum Class Visa Card earn 500 PQP for every $12,000 in card spend, up to 3,000 PQP in a calendar year, that can be applied up to 1K.

- The UnitedSM Presidential PlusSM Card and UnitedSM Presidential PlusSM Business Card earn 500 PQP for every $12,000 in card spend, up to 10,000 PQP in a calendar year, that can be applied up to 1K.

- UnitedSM TravelBank Cards do not earn PQP for card spend.

What Are Premier Qualifying Flights (PQF)?

Premier Qualifying Flights (PQF) are essentially the same thing as what we call a flight segment today.

United says that a single take-off and landing counts as 1 PQF so a roundtrip itinerary of San Francisco – Tokyo – Hong Kong – Tokyo – San Francisco would earn 4 PQFs towards elite status.

PQFs can be earned on:

- United

- United Express

- All United’s Preferred and MileagePlus partner airlines

PQFs will not be earned on:

- United Basic Economy Fares

- United award flights

- Partner Basic/Light fares

- Partner award tickets

- Any other partner flights that are not eligible for award mile accrual

Chase cardholders who were previously exempt from earning the minimum 4 segments on United/United Express that’s required for MileagePlus status will not be getting this exemption from 1 January 2020.

Thoughts

Wow. I never saw this coming.

As with most things, there will be winners and losers here but I suspect there will be more losers than winners.

Winners:

- Domestic road warriors who fly a lot of segments, spend a reasonable amount of money but don’t generally rack up a lot of mileage – with mileage no longer counting and segments aplenty status just got easier to earn for this group.

- MileagePlus members who spend a significant amount of money with United but who fly infrequently – they no longer need to worry about any other metric other than hitting the higher spending requirements.

Losers:

- MileagePlus members who mostly fly long-haul (where the number of sectors flown is usually low) and who look to buy the cheaper fares.

- Internationally based MileagePlus members – the elimination of the spending waiver isn’t balanced out by the increased number of ways to earn PQP.

- Chase MileagePlus co-branded credit card holders – the loss of spending waivers will be painful for some.

If I was a MileagePlus status holder right now I’d be looking for a new loyalty program as soon as possible as these changes are aimed squarely at making it harder for flyers like me to earn status.

I tend to fly long distances in both economy and premium cabins while spending as little as possible to earn the status I want and that’s the kind of travel pattern that makes it very hard to earn any kind of meaningful status with United – even if I hit the PQP targets I’d fall very short of the PQF target for any kind of meaningful MileagePlus status.

Flyers whose businesses/employers pay for them to book expensive fares are the biggest winners here as the number of flights they’ll have to take to earn status will be significantly less from next year – I can imagine a lot of Bay Area tech company employees earning Platinum/1K status with just 2 – 3 long haul flights.

Bottom Line

If you buy very expensive fares you’ll do well out of these changes. If you buy reasonably expensive fares and fly a lot you’ll probably do well out of these changes. If you’re an old school “fly far and fly cheap” kind of traveler you’re probably going to need to find another airline program.

How do you see these changes and how will they affect you – are you a winner or a loser here?

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

MileagePlus Upgrade Award co-pays* – Does this mean if I use miles to upgrade a paid for fair, I will receive PQP’s?

No. A co-pay is the cash element you pay alongside whatever miles you use to upgrade a flight so that cash element is what will now earn PQPs.

I am a legacy presidential plus card holder . What will the conversion ratio be for my banked Flexible PQM’s

Per United:

PQM (FPQM) balances will be converted and can be used as Flex PQP (FPQP) going forward at a ratio of 5:1. For example, a balance of 10,000 FPQM would become 2,000 FPQP. Flex balances that are converted can only be applied up to Platinum.

Full details: https://mileageplusupdates.com/mileageplus/english/qualification/#accordion-united-mileageplus-chase-cardmembers

What about the old (new apps stopped 2007), United Chase Signature card? This is the card that gives 1Ks 10’000 PQMs with $5k United.com spend and $30k overall spend.

Neither Chase or UA MP center can tell me how this will be impacted.

I can’t answer that question either but with mileage no longer being a contributing factor to eating elite status I would expect that benefit to go away. It may be replaced by an opportunity to earn PQP through spending but that’s also a guess on my part.

This seems normal for United, a program to discourage customer loyalty. If they want to make customers happy and more loyal, United would give people more benefits. c’est la vie

What about Marriott/Bonvoy Titanium Elite members? Will they still get complimentary Silver status with UA?

As no announcement has been made which would indicate that this is changing, I’d expect the status quo to continue.

[…] At the end of last week, shockwaves rumbled through the frequent flyer community as United Airlines announced huge changes to its MileagePlus program. […]

I am definitely as loser in this scenario. I fly Asia routes 3 times a year and maintain a Platinum level. Now according to this news, I wont even make Gold anymore. I read this article yesterday and have been scouring other programs since…I see an airline move in my future….

Really a bad move for the majority of long-term loyal customers. What is really odd is that the folks who spend the most are the ones who have the least need for status and upgrades, since they are already purchasing the Polaris seats and have access to the lounges. Customers like myself, working for a university which does not permit anything but economy-class travel, going to United for long-haul flights made a lot of sense, since we could qualify for the upgrade now and then. Now this is much less of a possibility. Since loyalty no longer matters to United, but dollars, why not have an electronic auction before take-off on every flight for unsold Polaris seats or Premium Economy seats? Loyalty no longer matters to United, so I will look elsewhere for travel. Farewell United.

These changes are not good for travelers like you, I agree. Bummer.

United is optimizing for business travelers who purchase the expensive tickets, but use the miles/upgrades for PERSONAL travel. I spend >$50k a year with United in business travel (Polaris) but I harvest the miles to fly with family. Using miles or upgrades, I can purchase economy tickets for personal travel and then upgrade to business. It’s a really nice perk for travelers like me.

But I totally get that this doesn’t serve travelers like you.

[…] A 14% increase in the point requirement to earn a Companion Pass cannot just be shrugged off (it’s significant) but it’s not in the same league as the recent changes we saw United put though to how Premier status is earned. […]

Definitely planning to cancel out my Pres Plus MasterCard as a result at the end of 2020. There is no way I will be able to spend enough to make gold or even silver like in years past- the only reason we flew United despite it being the most inconvenient airport to fly in and out of(ewr).

Any comparable suggestions for other airline cards?

Thanks!

[…] or loopholes). I won’t get into many more details about it as plenty of other sites have done it very well (and I guess I am a bit late to the game to do that), and this article is more focused on […]

United keeps tightening the screws of corporate greed on it’s most loyal customers for the sake of profits and satisfying shareholders, and brands each yearly change as an “improvement.” I’ve been studying the most recent overhaul of changes for weeks now making sense of the new program. I’ve been searching for theoretical future flights (planning out my 2020 travel) on united.com and I hardly see the point (or most importantly, value) in the cost of being loyal anymore, and a shame considering my account goes back to the Continental days. Now putting serious consideration in to draining my award miles, while starting fresh with a different carrier.

Too bad.

Shouldn’t your number of years of loyalty also somehow factor in to the equation??? There should be some sort of bonus/multiplier for every year of elite status… even if small. Are all those years of loyalty really worth nothing now? Feeling quite betrayed by the new program.