TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

As things stand, the three best credit cards to use when booking air travel are probably the Platinum Card from American Express (which earns 5 points/dollar on airfare booked direct with airlines), the Chase Sapphire Reserve credit card (which earns 3 points/dollar on most travel spend) and the Citi Prestige card (which earns 3 points/dollar on airfare booked direct with airlines but is currently closed to new applicants).

As I hold all three of the cards I just mentioned, and as I value the points those cards earn equally, logic would appear to dictate that I should use the Platinum Card for all my air travel spend.

I value Chase Ultimate Rewards points, Citi ThankYou points and Amex Membership Rewards points all at 1.5 cents each so it may seem strange that, at times, I choose to earn the equivalent of a 4.5% rebate through Chase or Citi rather than an effective 7.5% rebate through American Express…but there’s a very good reason for this.

Not all cards are created equal (not even premium cards like the three I’m discussing) and there’s an aspect of the Platinum Card that’s a big negative in certain situations.

Normally I book all my flights with the Platinum Card because I’m all about maximizing the points I earn, but the Platinum Card doesn’t offer one very key benefit that you get with the Chase Sapphire Reserve card and the Citi Prestige card – trip delay reimbursement.

Trip delay reimbursement is essentially insurance cover for when your flight is delayed and you’re left at the mercy of the airlines (often overnight).

Airlines are notoriously terrible at looking after passengers when things go wrong so it’s always a good idea to have a backup plan for when the airlines inevitably let you down.

Here’s what the Chase Sapphire Reserve’s benefits section says about such insurance:

Trip Delay Reimbursement

If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

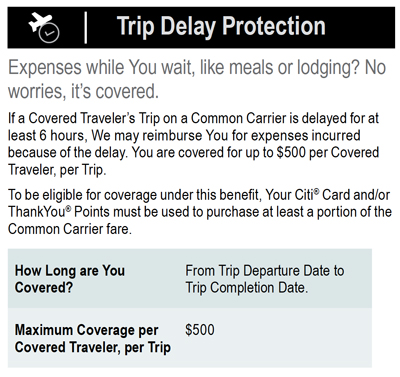

And here’s what Citi has to say in the Prestige card benefits literature:

Having to have a delay of over 6 hours before the insurance kicks in isn’t great (if you don’t have lounge access you’ll have to feed and water yourself for shorter delays) but it’s definitely better than nothing (which is what Amex offers).

Normally I’m not too worried about having trip delay insurance as don’t often fly in/out of cities that are notorious for bad weather (NYC, Chicago etc..) but I do like to have it when I see a potential for trouble.

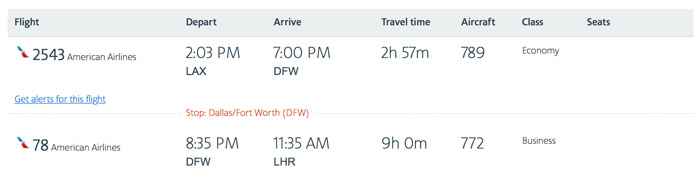

Take the example of a trip I have early in 2019 when I’m flying from LA to London.

Rather than take one of the non-stop flights that operate daily between LA and London I’ve chosen to book myself on a routing via Dallas to use up my last American Airlines systemwide upgrade (there was no upgrade availability out of LA but there was out of Dallas).

I’ve also chosen to book myself on the last possible flight out of LA which only leaves me with a 95 minute connection time in Dallas.

For most of the year a connection time of 95 minutes is more than enough when you’re connecting from one American Airlines flight to another (in Dallas) but this trip is at a time of year where things may not be running as smoothly as I’d like them to be – this is a winter trip.

I’ve been caught up in a winter snowstorm in Dallas before and it was only thanks to the amazing work of the excellent Admirals Club agents that I got out of town on the day I intended to – a lot of people were forced to stay overnight.

I’d rather that didn’t happen to me again but, if it is going to happen, I plan to be prepared.

AA78 is the last London flight of the day so should I miss it or if were to be cancelled I’d be stuck in Dallas overnight…and I’d prefer not to have to rely on the generosity of American Airlines to make sure I’m ok.

Had I booked my trip using the Platinum Card from American Express I would have no cover in the event of an issue arising but, as I’ve used my Chase Sapphire Reserve card to pay for my flights, that’s not the case.

Should the weather take a turn for the worse (or should something else go wrong) I’ll be booking the Hyatt Regency DFW the moment I know that I’m going to be stuck (it’s a pretty good hotel and is attached to Terminal D at DFW so it’s convenient too) and I’ll be safe in the knowledge that Chase will compensate me for whatever expenses I incur (up to $500).

If I was to leave my fate in the hands of American Airlines there’s no knowing what time they’ll find me somewhere to stay or if there will even be any hotel rooms left by the time they get around to dealing with me.

In the case of flight delays every frequent flyer lives by one important rule:

Take charge of your own situation as soon as you can and deal with the consequences (costs) later. You can’t be sure that the airline will take care of you and, even if they eventually do get to you, the options left may not be options you really care for.

There Will Be A Higher Earning Option Soon…But I May Not Have It

From January 2019 the Citi Prestige card will reopen to new applicants and start to offer 5 points/dollar for all airfares booked directly with the airlines. This means that travelers won’t necessarily have to choose between great points earning and trip coverage any more…but I may not be among them.

I’m not yet convinced that the Citi Prestige is a card worth keeping following the recent changes so I may well be getting rid of it before the annual fee is raised (yes, I’m aware that I’ve threatened to cancel this card on numerous occasions in the past).

The choice of Platinum Card or Chase Sapphire Reserve could be the choice I’m faced with until someone else offers a better alternative.

Bottom Line

I do a pretty decent job of ensuring that I don’t leave myself too many tight connections when I’m booking my flights and, as I’m the boss of my travel plans, I generally avoid high-risk airports when the weather looks like it may be unhelpful…so trip delay insurance isn’t as important to me as it will be to some.

I’m lucky in that I have the freedom to continue using the Platinum Card for most of my flight bookings (and earning the 5 points/dollar that the card offers) because I can pick and chose where and when I fly so I can avoid potential issues when I think they’ll arise….but that’s not the reality for road warriors.

If you fly a lot (probably as part of your job) you’re bound to face situations where a weather system has caused chaos to the flight schedules and possibly even closed down airports (that’s just a fact of your life) so make sure you’re in a position to bail yourself out of whatever situation the airline or weather system has got you into – make sure you know what travel insurance comes with the credit cards you’re using and make sure you use the right card for your situation.

I know we’re usually all about earning the most miles and points in this hobby but sometimes the sensible option isn’t the one that boosts your loyalty balances the most.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

You logic escapes me. Why book a 95 minute connection that you think you might miss and forgo extra points just so you can rely on the hassle of “free” travel insurance? Book a longer connection and get your 5x AMEX points and be done with it. Re-book your flights under a weather waiver on the day of travel to avoid any problems that may arise. It’s not like a hotel night is going to cost $500+ if you are forced to spend the night on your own dime, plus you’ll save a hotel night at the destination, as hotels virtually always let you make free changes when you cannot reach your detonation due to weather.

I booked the flight I booked because I wanted to fly the specific aircraft that flight offers.

I don’t think I may miss my connection (I dont book flights where I think something will go wrong), I think there’s an outside chance that something may go wrong – there’s a big difference.

In this case I’m happy to take fewer points for peace of mind and I don’t see a problem with doing that.

It would be nice if you can share your experience on any successful claims with Chase on these trip delay insurance.

I read at a few places that lately (blog/reddit), Chase reimbursement/insurance team is making it extra difficult to credit back these claims, even when they are actual legitimate claims with receipts and all. No follow up, constant pending status on the claim, and constant calling in to check status. This poor guy took about 4-5 months to get a few measly $300 credit.

That sounds like terrible customer service! I’ve been fortunate so far in that I haven’t had to make a claim against my credit card policies so I can’t give any feedback at this point…but I’ll bear your suggestion in mind and I’ll make sure I write a detained post should I ever have to call on Chase (or any other card issuer to bail me out.