TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

With airlines making it harder and harder to earn redeemable miles from flying more and more people have been turning to credit cards and the sign-up bonuses they offer as their primary source of miles.

With an ever increasing number of people happy to churn credit cards (open a card, earn the bonus, close the card and repeat) in the quest for cheap travel, most financial institutions have been bringing in rules to limit the number of sign-up bonuses one person can earn.

Amex’s rule allows for only one sign-up bonus per credit card per lifetime (there are exceptions to this), Chase has its famous 5/24 rule and Citi has, up until now, restricted sign-up bonuses to one per card family per 24 months.

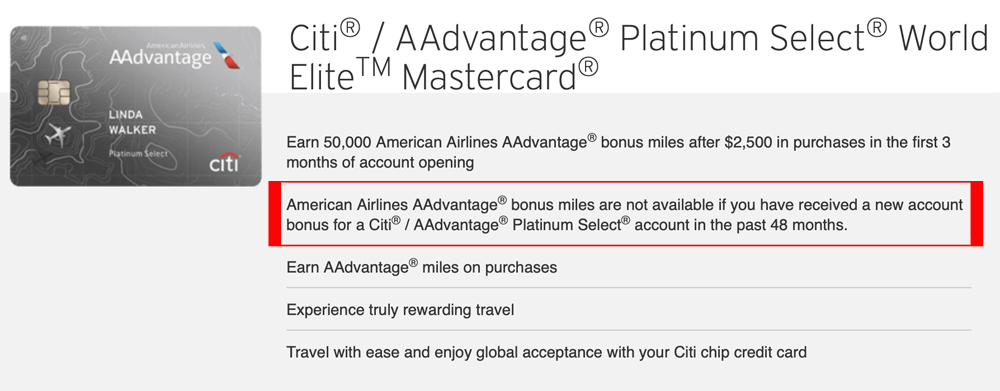

If you hard over to Citi.com right now and read the t&cs for the Citi AAdvantage Platinum Select World Elite Mastercard this is the condition you’ll see for receiving the signup bonus:

American Airlines AAdvantage® bonus miles are not available if you have had any Citi® / AAdvantage® card (other than a MileUpSM or CitiBusiness® / AAdvantage® card) opened or closed in the past 24 months.

If you check out the Citi Prestige application page this is the sign-up bonus wording you’ll see:

Bonus ThankYou Points are not available if you received a new cardmember bonus for Citi Rewards+℠, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi Premier℠ or Citi Prestige®, or if you have closed any of these cards, in the past 24 months.

In both cases the terms are clear in that you will not receive the sign-up bonus for a new card if you’ve opened or closed a similar card in the past 24 months…but now take a look at this:

Travel In Points has found links to two of Citi’s American Airlines AAdvantage cards where the language is noticeably different when it comes to who can and cannot earn the sign-up bonus:

Link to Citi AAdvantage Platinum Select World Elite Mastercard new wording

What’s interesting here is that the news isn’t all bad.

Yes, clearly a restriction that says you can only earn a sign-up bonus on a Citi credit card once every 4 years isn’t great news…but there are two things I like about this change.

- I like the fact that the restriction no longer appears to apply to all cards of the same family

- I like the fact that closing a Citi card no longer seems to reset the clock on when you can next get a sign-bonus.

While the new rules mean that you can only earn a sign-up bonus on the Citi AAdvantage Platinum Select World Elite Mastercard (for example) once every 4 years, there’s no longer anything in the t&cs to stop someone from also getting a sign-up bonus on the CitiBusiness AAdvantage Platinum Select Master card, the Citi AAdvantage Executive Mastercard and the American Airlines AAdvantage MileUp credit card.

Where under the current rules you can only get one sign-up bonus from a Citi AAdvantage credit card every 24 months, the new rules would allow you to earn 4 sign-up bonuses (across different AAdvantage cards) in a very short space of time.

That’s not bad.

Bottom Line

As things stand, application links with the new 48-month wording in the terms and conditions are pretty hard to find (kudos to Travel In Points for finding a few) but I suspect this may be something we see Citi roll out over the coming months – it’s unlikely that this is just a typo or an error on Citi’s part.

Personally I’ll take the 48-month rule if it means that we see the end of the embargo on sign-up bonuses on other cards in the same family (it would be great to get a sign-up bonus on the Citi Prestige and Citi Premier cards) and the end of card closures resetting the clock on earning a sign-up bonus….but how do you feel?

[HT: Doctor of Credit]

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)