TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

I hold just one airline credit card and it’s the AAdvantage Aviator card from Barclays. I don’t hold the Citi AAdvantage Executive World Elite Mastercard because I have no need for the benefits it offers….but then I’m not representative of the group who can make the most of the benefits the card offers.

The Citi AAdvantage Executive Card

I was one of the early adopters of the Citi AAdvantage Executive World Elite Mastercard when it was first introduced as, for a regular American Airlines flyer, it offered a number of very useful benefits that were unavailable elsewhere.

Over time my travel patterns changed and one of the key benefits this card bestows – Admirals Club membership – because surplus to my needs. At that point I could no longer justify the $450 annual fee and I cancelled the card.

Having said that, the card can still be very useful to anyone who flys with any sort of frequency on American Airlines (especially domestically) as the overall benefits package can be a serious money saver.

Here are the main features of the Citi AAdvantage Executive World Elite Mastercard:

- Earn 2 AAdvantage Miles per dollar spent on American Airlines purchases

- Earn 1 AAdvantage Mile per dollar spent on all non-American Airlines purchases

- Admirals Club membership with the right to invite up to 2 guests into the clubs

- Add up to 10 authorised users at no cost.

- Authorised users have access to Admiral’s clubs and can invite up to two guests each into the clubs.

- $100 credit towards Global Entry or TSA PreCheck every 5 years

- Earn 10,000 Elite Qualifying Dollars after spending $40,000 in a calendar year.

- 25% saving s on in-flight food and drinks when using the card

- Priority check-in & priority airport screening (where available)

- Priority boarding (Group 4)

Saving Money With The Citi AAdvantage Executive Card

If you don’t need Admirals Club access then this card probably isn’t for you (even if does offer 10,000 EQM after $40,000 spend) but if you’re a flyer who purchases Admirals Club membership then this is a credit card you probably shouldn’t be without.

Through 31 January 2019 this is what Admiral’s Club pricing looks like….

…and this is what it’s going to look like from 1 February 2019:

If you ordinarily buy Admirals Club membership for yourself only, this is what the net cost of holding the Citi Executive Card currently looks like (based on the renewal fee and depending on your AAdvantage status):

- Executive Platinum: $50

- Platinum Pro: $25

- Platinum: $0

- Gold: -$25

- No Status: – $75

If you don’t have AAdvantage status or if you’ve only got Gold status right now you can pick up the Citi Executive card for less than you’re paying for Admirals Club membership and keep your membership as well.

Once the price increases take effect in a little over a week’s time every American Airlines flyer who ordinarily pays for Admirals Club membership will be noticeably financially better off by having the Citi AAdvantage Executive World Elite Mastercard rather than buying membership.

Note: I haven’t even taken into account the fact that the Citi Executive Card effectively allows you to give Admirals Club access to up to 10 other people free of charge and those 10 people can each bring 2 guests in to the lounge when they visit.

The Elite Qualifying Dollars that this card offers may also help you save a little money.

It’s entirely possible that, towards the end of the elite qualification year, you’ve earned enough Elite Qualifying Dollars to achieve your desired level of status but you’re still short when it comes to the number of Elite Qualifying Miles (EQM) required.

This is where the 10,000 EQM that the card gives you (after $40,000 in spend) comes in to play – it can save you from having to take a flight (or flights) that you otherwise may not have taken had you not needed to earn more EQM to hit your status targets.

Clearly $40,000 is a lot of spend to put on a single credit card – especially one that only offers 1 mile/dollar on no American Airlines spend – but at least the option is there.

Sign Up Bonus

As far as I can tell the current sign-up bonus for the Citi AAdvantage Executive Card is 50,000 points which is paid out after you spend $5,000 in the first 3 months of card membership.

Here’s the offer as it appears on the Citi webpage right now:

But there’s a better offer out there.

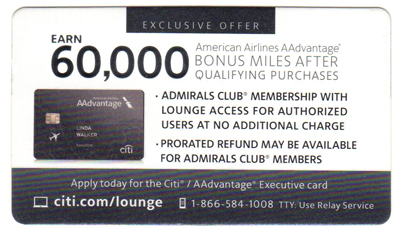

I was at the Flagship Lounge at LAX yesterday and small stacks of the following card were prominently placed on the lounge agents’ desks:

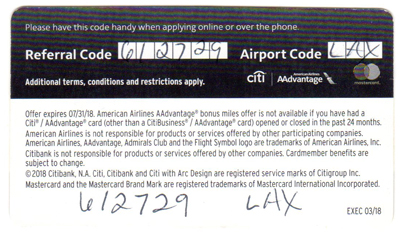

For some reason the expiry date shown on the back of the card reads 07/31/18 but, considering these cards are still being passed out, I’m assuming that expiry date has been superseded.

Also, be aware of the following disclaimer:

“American Airlines Advantage bonus miles offer is not available if you have had a Citi AAdvantage card (other than a CitiBusiness AAdvantage card) opened or closed on the past 24 months.”

As often as I pass through the LAX Flagship Lounge I rarely have a need to visit the agents so I have no idea how long those cards have been available (presumably it has been a while) but, as the Citi webpage is only showing a 50,000 mile bonus, I thought I’d share this promotion in case anyone can make the most of it.

Final Thought

I don’t know if the referral code on the card scanned above is a one-time code or if the same code is on all the promotional cards but I do know that the code above (612729) has not yet been used….at least not at the time of writing.

If you plan on applying for the Citi AAdvantage Executive card and you’re not passing through LAX (other lounges may be offering this too) I suggest calling up Citi and seeing if their agents can help you out – I don’t see any reason why they wouldn’t.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

FYI. the referral code is reusable.