TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

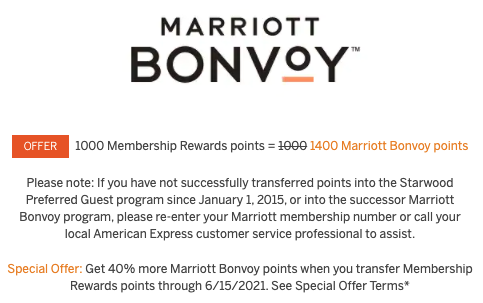

Before today, we hadn’t seen a new Marriott transfer bonus from American Express since September 2020 but as of this morning, anyone wishing to transfer Membership Rewards Points over to their Bonvoy account can do so with a 40% bonus thrown in for good measure.

American Express Membership Rewards offers transfers to just three hotel loyalty programs and one of these is Marriott Bonvoy. Right now AMEX is offering a 40% bonus on all Membership Rewards points transferred over to Marriott by 16 June 2021 but this is a “deal” that almost everyone should be approaching with care.

Before I even consider the math behind this transfer offer, a key thing to note is that Amex has been known to offer bonuses of up to 50% on transfers to Marriott Bonvoy in the past, so this is not the best deal we’re ever likely to see – keep this in mind when deciding whether now is the best time for you to action a transfer.

The Math

I value Membership Rewards points at 1.5 cents each and, as valuations go, this is probably one of the more conservative valuations you’ll see.

When it comes to Marriott Bonvoy points I struggle to value them at anything higher than 0.6 cents each so with this transfer bonus seeing AMEX Membership Rewards points converting to Marriott Bonvoy points at a ratio of 1 to 1.4, I’m essentially being asked to convert points worth 1.5 cents each into points worth 0.84 cents.

On the face of things, that looks like a terrible deal (and for many people it will be) but there are times when a transfer from Amex to Marriott can make a lot of sense so it’s important not to dismiss this transfer bonus out of hand.

Allow me to explain…

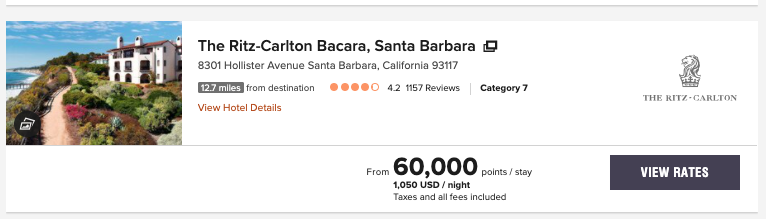

On a random night in July, the Ritz-Carlton Bacara Santa Barbara will charge a guest $1,015 (including taxes and fees) or 60,000 points + 63.70 in resort fees and taxes.

Buy using points instead of cash to make this booking, a Marriott Bonvoy member could get approximately 1.59 cents of value out of every Bonvoy point used, and that’s pretty incredible when you consider that they’re not really worth more than 0.6 cents each and when you consider that Marriott will sell you points at approximately 0.833 cents each right now.

If you’ve been targeted for a 40% transfer bonus, 60,000 Marriott Bonvoy points can be generated from 43,000 Amex Membership Rewards points which, based on my valuation of 1.5 cents/point, are worth $645. In this example, a transfer of Amex Membership Rewards points to Marriott would see you effectively pay $709 for a night which would otherwise have cost $1,015.

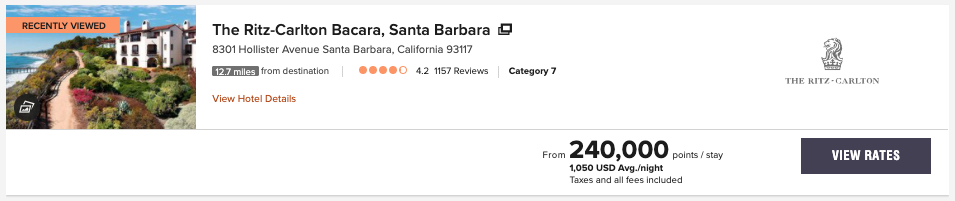

Things can look even better on stays of 5 nights thanks to the fact that Marriott Bonvoy members get the 5th night free on award bookings.

A 5-night stay at the Ritz-Carlton Bacara Santa Barbara in August can cost $1,015/night ($5,075) or 240,000 points + $319 in resort fees and taxes.

240,000 Bonvoy points can be generated from 172,000 Membership Rewards points which, based on my valuation of 1.5 cents/point, are worth $2,580.

When you add in the obnoxious resort fees and taxes that get added on to the award booking, someone transferring Amex Points over to Marriott to make this 5-night booking would effectively be handing over $2,899 of points and cash in exchange for a booking that otherwise would have cost $5,075.

That’s a saving of $2,176.

Yes, this is an extreme example (although, ironically, it was the first example I found) so there will be plenty of other examples where transferring Amex points over to Marriott makes no sense whatsoever. But I mentioned that towards the beginning of this post.

What I’m trying to show with the Ritz-Carlton example is that what may appear to be an obviously terrible deal at first glance, may not really be terrible in all circumstances. If you’re booking high-end properties that cost a lot of money, a transfer of Amex points may be a very good idea.

Bottom Line

The majority of the time the math will dictate that transferring Membership Rewards points to Marriott Bonvoy is a poor value proposition regardless of what transfer bonus you’ve been targeted for because Membership Rewards points are so much more valuable than Bonvoy points. As shown above, however, there will be times when a transfer makes sense and when it can save you a substantial sum of money.

If you’re topping up an account or booking a standard room at a property where prices are high (especially if you’re booking a 5-night stay) then a transfer from Amex may save you quite a bit of cash, but make sure you do the math before you enact any transfer as there’s no going back!

Did you get targeted for a 40% transfer bonus or something else?

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

This promo is not a good deal unless you need to top up for an award. Marriott points were worth 3 to 1 vs. Starwood and they typical transfer of Amex to a travel partner is 1 to 1 (Bonvoy is at best, 1 to 2 and likely 1 to 3.

I respectfully disagree. As shown in the post above, the promo can also be useful if you have your heart set on what would otherwise be an expensive cash stay.